Question: Can you please include a detailed explanation for these so I can understand it fully? Thank you so much ( I highly appreciate it if

Can you please include a detailed explanation for these so I can understand it fully? Thank you so much ( I highly appreciate it if it's the right solutions hehe)

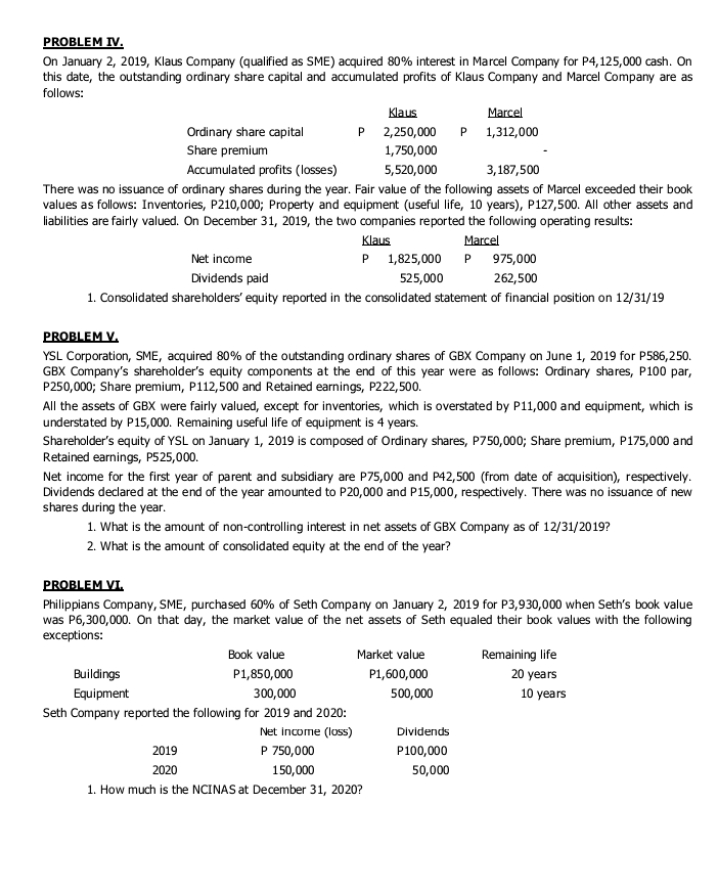

PROBLEM IV. On January 2, 2019, Klaus Company (qualified as SME) acquired 80% interest in Marcel Company for P4,125,000 cash. On this date, the outstanding ordinary share capital and accumulated profits of Klaus Company and Marcel Company are as follows: Klaus Marcel Ordinary share capital P 2,250,000 P 1,312,000 Share premium 1,750,000 Accumulated profits (losses) 5,520,000 3,187,500 There was no issuance of ordinary shares during the year. Fair value of the following assets of Marcel exceeded their book values as follows: Inventories, P210,000; Property and equipment (useful life, 10 years), P127,500. All other assets and liabilities are fairly valued. On December 31, 2019, the two companies reported the following operating results: Klaus Marcel Net income P 1,825,000 P 975,000 Dividends paid 525,000 262,500 1. Consolidated shareholders' equity reported in the consolidated statement of financial position on 12/31/19 PROBLEMV. YSL Corporation, SME, acquired 80% of the outstanding ordinary shares of GBX Company on June 1, 2019 for P586,250. GBX Company's shareholder's equity components at the end of this year were as follows: Ordinary shares, P100 par, P250,000; Share premium, P112,500 and Retained earnings, P222,500. All the assets of GBX were fairly valued, except for inventories, which is overstated by P11,000 and equipment, which is understated by P15,000. Remaining useful life of equipment is 4 years. Shareholder's equity of YSL on January 1, 2019 is composed of Ordinary shares, P750,000; Share premium, P175,000 and Retained earnings, P525,000. Net income for the first year of parent and subsidiary are P75,000 and P42,500 (from date of acquisition), respectively. Dividends declared at the end of the year amounted to P20,000 and P15,000, respectively. There was no issuance of new shares during the year. 1. What is the amount of non-controlling interest in net assets of GBX Company as of 12/31/2019? 2. What is the amount of consolidated equity at the end of the year? PROBLEM VL. Philippians Company, SME, purchased 60% of Seth Company on January 2, 2019 for P3,930,000 when Seth's book value was P6,300,000. On that day, the market value of the net assets of Seth equaled their book values with the following exceptions: Book value Market value Remaining life Buildings P1,850,000 P1,600,000 20 years Equipment 300,000 500,000 10 years Seth Company reported the following for 2019 and 2020: Net income (loss) Dividends 2019 P 750,000 P100,000 2020 150,000 50,000 1. How much is the NCINAS at December 31, 2020