Question: can you please please help me answer this one can you please help me answer this one Problem 2 (20%) Calculate the present worth (PW)

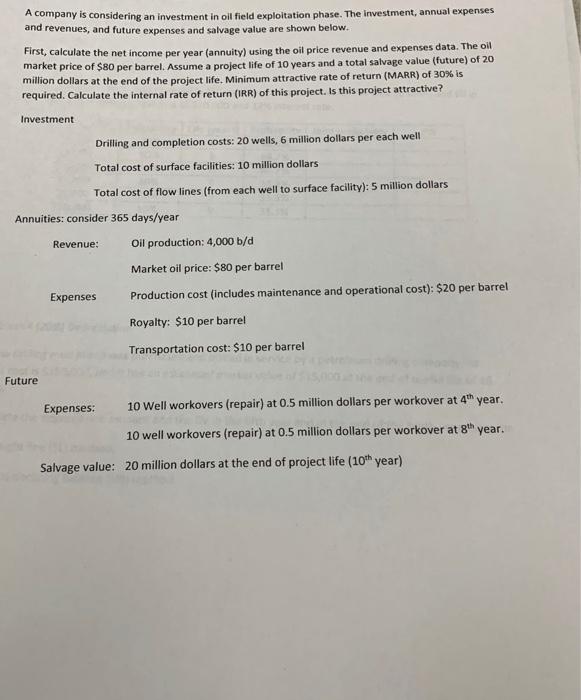

Problem 2 (20%) Calculate the present worth (PW) for the previous problem assuming an interest rate of 30%. A company is considering an investment in oil field exploitation phase. The investment, annual expenses and revenues, and future expenses and salvage value are shown below. First, calculate the net income per year (annuity) using the oil price revenue and expenses data. The oil market price of $80 per barrel. Assume a project life of 10 years and a total salvage value (future) of 20 million dollars at the end of the project life. Minimum attractive rate of return (MARR) of 30% is required. Calculate the internal rate of return (IRR) of this project. Is this project attractive? Investment Drilling and completion costs: 20 wells, 6 million dollars per each well Total cost of surface facilities: 10 million dollars Total cost of flow lines (from each well to surface facility): 5 million dollars Annuities: consider 365 days/year Revenue: oil production: 4,000 b/d Market oil price: $80 per barrel Expenses Production cost (includes maintenance and operational cost): $20 per barrel Royalty: $10 per barrel Transportation cost: $10 per barrel Future Expenses: 10 Well workovers (repair) at 0.5 million dollars per workover at 4th year 10 well workovers (repair) at 0.5 million dollars per workover at 8th year. Salvage value: 20 million dollars at the end of project life (10th year) Problem 2 (20%) Calculate the present worth (PW) for the previous problem assuming an interest rate of 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts