Question: can you please provide Excel working too if you use it? Thank you! a) Suppose you have invested all your capital ($30,000) in a portfolio

can you please provide Excel working too if you use it? Thank you!

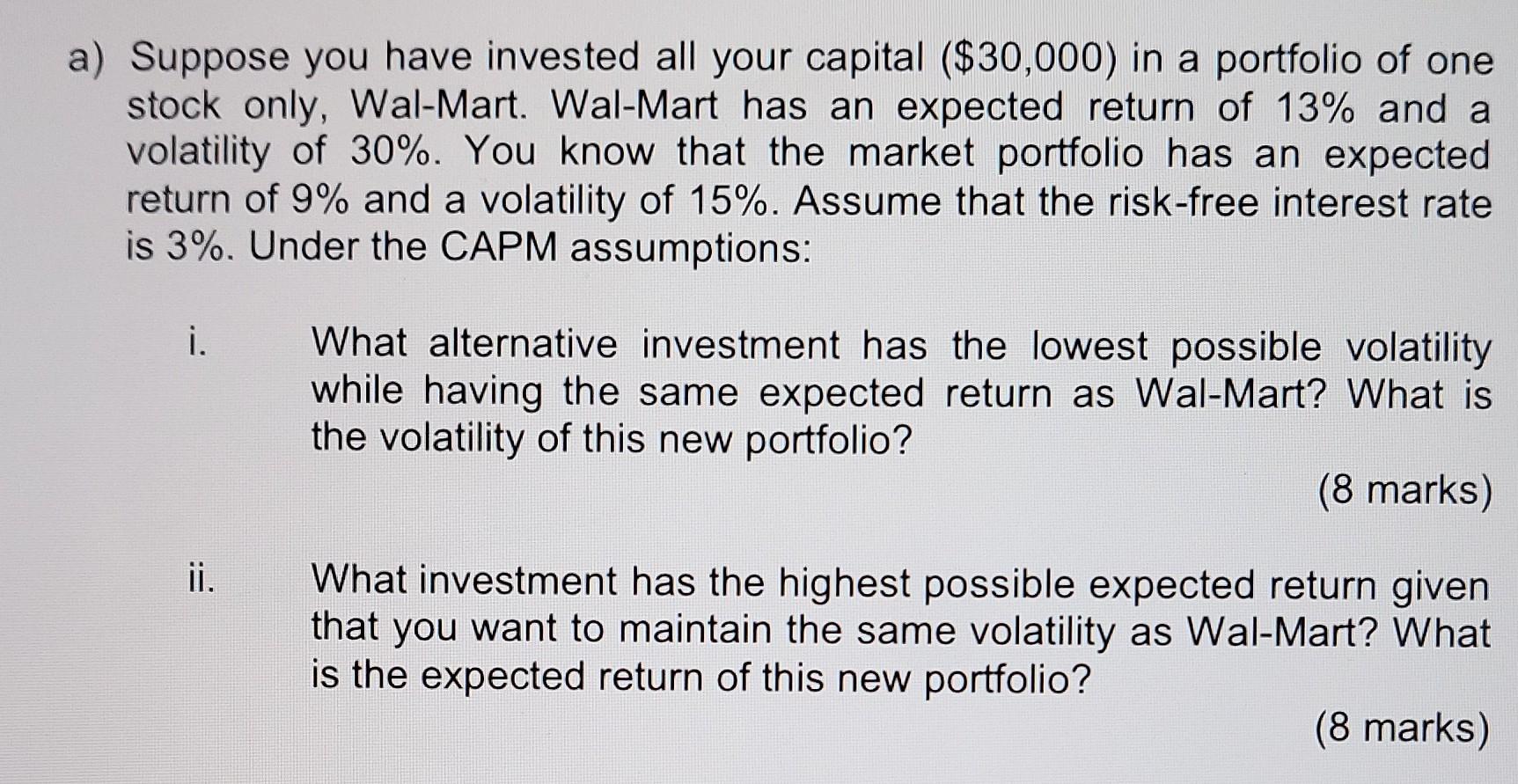

a) Suppose you have invested all your capital ($30,000) in a portfolio of one stock only, Wal-Mart. Wal-Mart has an expected return of 13% and a volatility of 30%. You know that the market portfolio has an expected return of 9% and a volatility of 15%. Assume that the risk-free interest rate is 3%. Under the CAPM assumptions: i. What alternative investment has the lowest possible volatility while having the same expected return as Wal-Mart? What is the volatility of this new portfolio? (8 marks) ii. What investment has the highest possible expected return given that you want to maintain the same volatility as Wal-Mart? What is the expected return of this new portfolio? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts