Question: Can you please provide me a step by step guide on how to solve these financial problems including which formulas to use and why? I

Can you please provide me a step by step guide on how to solve these financial problems including which formulas to use and why? I am trying to learn which formulas to use in these examples and am confused on what process I should use. Can you please assist and also provide a link where I can download the excel spreadsheet? Thank you!

Can you please provide a spreadsheet with the values as well? Please do not skip steps, i am trying to learn, thank you!

?

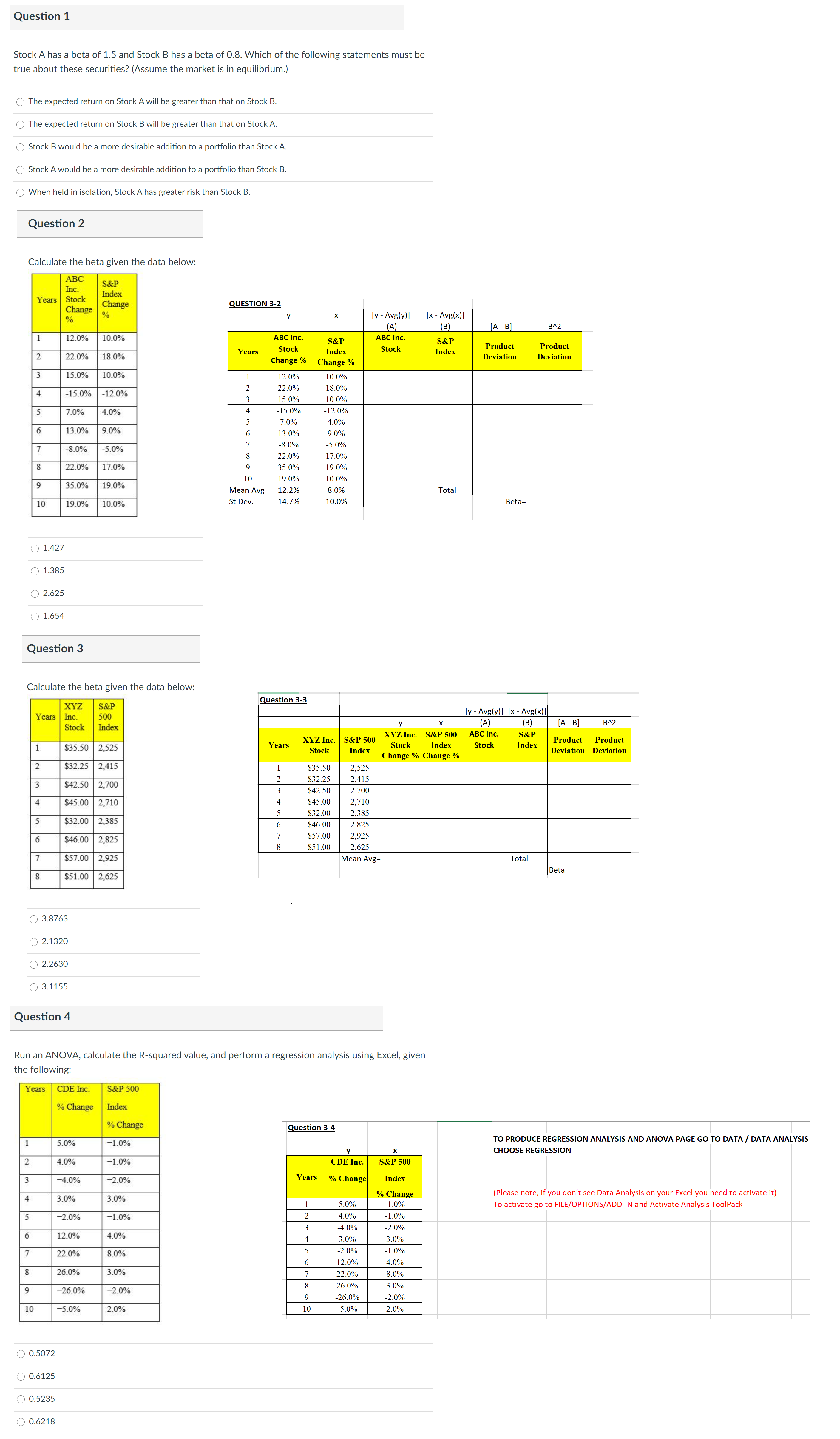

Question 1 Stock A has a beta of 1.5 and Stock B has a beta of 0.8. Which of the following statements must be true about these securities? (Assume the market is in equilibrium.) The expected return on Stock A will be greater than that on Stock B. The expected return on Stock B will be greater than that on Stock A. O Stock B would be a more desirable addition to a portfolio than Stock A. Stock A would be a more desirable addition to a portfolio than Stock B. When held in isolation, Stock A has greater risk than Stock B. Question 2 Calculate the beta given the data below: S&P Stock Index Years Change Change% QUESTION 3-2 [y - Avg(y)] [x - Avg(x)] (A) (B) A - B] BA2 12.0% 10.0% ABC Inc. S&P ABC Inc S&P Stock Stock Product Product 22.0% 18.0% Years Index Index Change % Change % Deviation Deviation 15.0% 10.0% 12.0% 10.0% -12.0% 22.0% 18.0% -15.0% 15.0% 10.0% 7.0% 4.0% -15.0% -12.0% 7.0% 4.0% 13.0% 9.0% 13.0% 9.0% -8.0% -5.0% 7 -8.0% -5.0% 22.0% 17.0% 22.0% 17.0% 9 35.09 19.0% 10 19.0% 10.0% 35.0% 19.0% Mean Avg 12.2% 8.0% Total 10 19.0% 10.0% St Dev. 14.7% 10.0% Beta= O 1.427 O 1.385 O 2.625 O 1.654 Question 3 Calculate the beta given the data below: XYZ S&P Question 3-3 Inc. 500 [y - Avg(y)] [x - Avg(x)] Stock Index (A) (B) [A - B] B^2 XYZ Inc. S&P 500 XYZ Inc. S&P 500 ABC In S&F $35.50 2,525 Years Index Stock Index Stock Index Product Product Stock Change % Change % Deviation Deviation $32.25 2,415 $35.50 2,525 $42.50 2,700 $32.25 2,415 $42.50 2,700 $45.00 2,710 VIA W N $45.00 2,710 $32.00 2.385 $32.00 2,385 $46.00 2.825 $46.00 2,825 $57.00 2,925 $51.00 2,625 $57.00 2,925 Mean Avg= Total Beta $51.00 2,625 3.8763 2.1320 O 2.2630 3.1155 Question 4 Run an ANOVA, calculate the R-squared value, and perform a regression analysis using Excel, given the following: Years CDE Inc. S&P 500 % Change Index % Change Question 3-4 5.0% -1.0% TO PRODUCE REGRESSION ANALYSIS AND ANOVA PAGE GO TO DATA / DATA ANALYSIS CHOOSE REGRESSION 4.0% -1.0% CDE Inc. S&P 500 -4.0% -2.0% Years % Change Index 3.0% 3.0% % Change Please note, if you don't see Data Analysis on your Excel you need to activate it) 5.0% -1.070 To activate go to FILE/OPTIONS/ADD-IN and Activate Analysis ToolPack -2.0% -1.0% 4.0% -1.0% -4.0% -2.0% 12.0% 4.0% 3.0% 3.0% 22.0% 8.0% -2.0% -1.0% 12.0% 4.0% 26.0% 3.0% 22.0% 8.0% 26.0% 3.0% -26.0% -2.0% -26.0% -2.0% 10 -5.0% 2.0% 10 -5.0% 2.0% O 0.5072 O 0.6125 O 0.5235 0.6218