Question: Can you please provide steps / plan how to begin this please. Assuming you were employed as a risk analyst for a UK investment bank.

Can you please provide stepsplan how to begin this please.

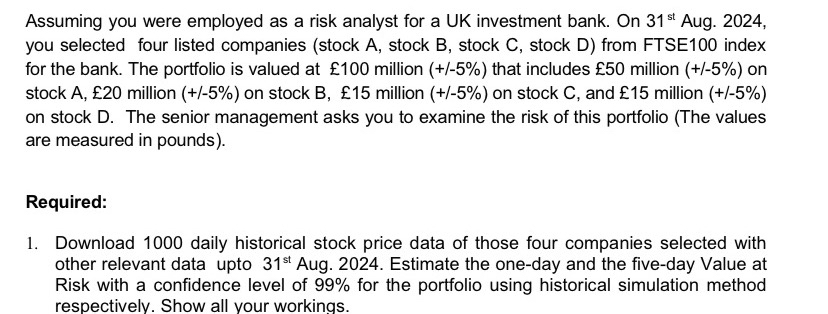

Assuming you were employed as a risk analyst for a UK investment bank. On Aug.

you selected four listed companies stock A stock B stock C stock D from FTSE index

for the bank. The portfolio is valued at million that includes million on

stock A million on stock B million on stock C and million

on stock D The senior management asks you to examine the risk of this portfolio The values

are measured in pounds

Required:

Download daily historical stock price data of those four companies selected with

other relevant data upto Aug. Estimate the oneday and the fiveday Value at

Risk with a confidence level of for the portfolio using historical simulation method

respectively.

Assuming you were employed as a risk analyst for a UK investment bank. On Aug.

you selected four listed companies stock A stock B stock C stock D from FTSE index

for the bank. The portfolio is valued at million that includes million on

stock A million on stock B million on stock C and million

on stock D The senior management asks you to examine the risk of this portfolio The values

are measured in pounds

Required:

Download daily historical stock price data of those four companies selected with

other relevant data upto Aug. Estimate the oneday and the fiveday Value at

Risk with a confidence level of for the portfolio using historical simulation method

respectively.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock