Question: Can you please provide the answer for all the four questions with clear explanations. All the information are in the attached files. ADVANCED FINANCIAL REPORTING

Can you please provide the answer for all the four questions with clear explanations.

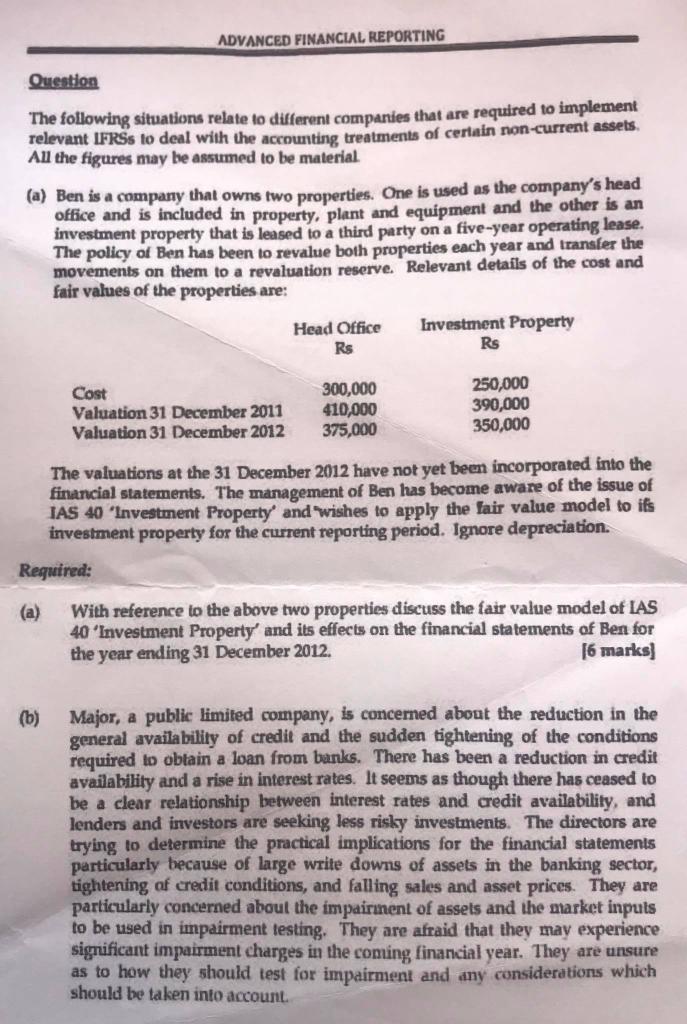

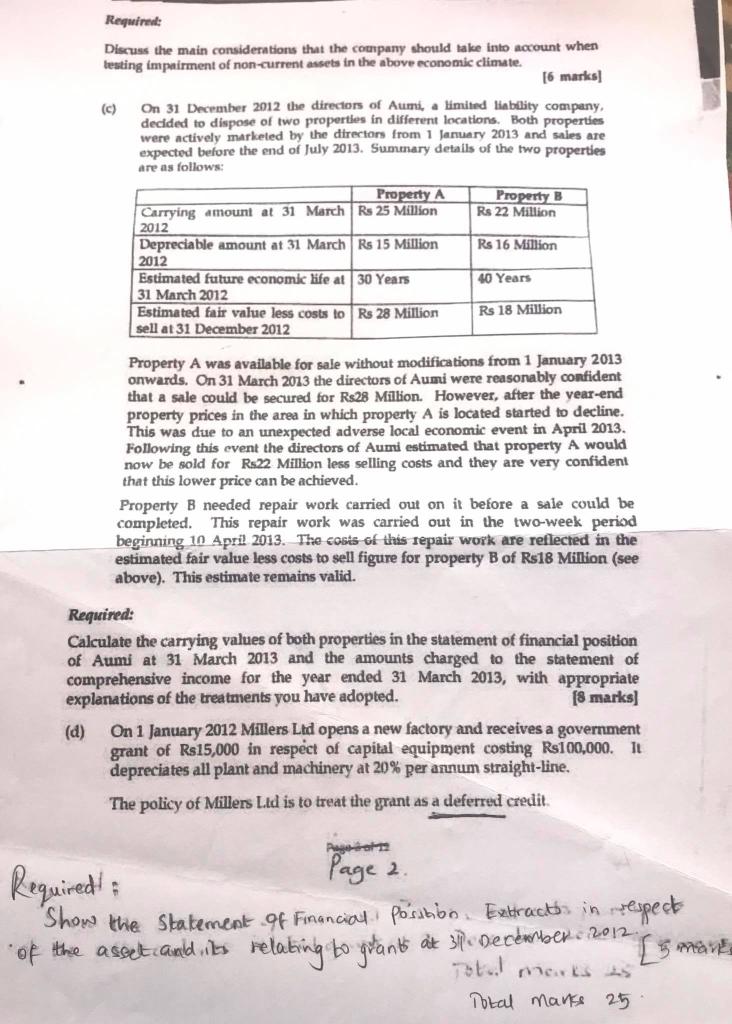

ADVANCED FINANCIAL REPORTING Question The following situations relate to different companies that are required to implement relevant IFRSs to deal with the accounting treatments of certain non-current assets. All the figures may be assumed to be material. (a) Ben is a company that owns two properties. One is used as the company's head office and is included in property, plant and equipment and the other is an investment property that is leased to a third party on a five-year operating lease. The policy of Ben has been to revalue both properties each year and transfer the movements on them to a revaluation reserve. Relevant details of the cost and fair values of the properties are: Head Office Rs Investment Property Rs Cost Valuation 31 December 2011 Valuation 31 December 2012 300,000 410,000 375,000 250,000 390,000 350,000 The valuations at the 31 December 2012 have not yet been incorporated into the financial statements. The management of Ben has become aware of the issue of IAS 40 'Investment Property and wishes to apply the fair value model to its investment property for the current reporting period. Ignore depreciation. Reguired: With reference to the above two properties discuss the fair value model of IAS 40 'Investment Property' and its effects on the financial statements of Ben for the year ending 31 December 2012. [6 marks) (b) Major, a public limited company, is concerned about the reduction in the general availability of credit and the sudden tightening of the conditions required to obtain a loan from banks. There has been a reduction in credit availability and a rise in interest rates. It seems as though there has ceased to be a clear relationship between interest rates and credit availability, and lenders and investors are seeking less risky investments. The directors are trying to determine the practical implications for the financial statements particularly because of large write downs of assets in the banking sector, tightening of credit conditions, and falling sales and asset prices. They are particularly concerned about the impairment of assets and the market inputs to be used in impairment testing. They are afraid that they may experience significant impairment charges in the coming financial year. They are unsure as to how they should test for impairment and any considerations which should be taken into account. Required: Discuss the main considerations that the company should take into account when testing impairment of non-current assets in the above economic climate [6 marks] (c) On 31 December 2012 the directors of Aumi, a limited liability company, decided to dispose of two properties in different locations. Both properties were actively marketed by the directors from 1 January 2013 and sales are expected before the end of July 2013. Summary details of the two properties are as follows: Property A Property B Carrying amount at 31 March Rs 25 Million Rs 22 Million 2012 Depreciable amount at 31 March Rs 15 Million Rs 16 Million 2012 Estimated future economic life at 30 Years 40 Years 31 March 2012 Estimated fair value less costs to Rs 28 Million Rs 18 Million sell at 31 December 2012 Property A was available for sale without modifications from 1 January 2013 onwards. On 31 March 2013 the directors of Aumi were reasonably confident that a sale could be secured for Rs28 Million. However, after the year-end property prices in the area in which property A is located started to decline. This was due to an unexpected adverse local economic event in April 2013. Following this event the directors of Aumi estimated that property A would now be sold for R.22 Million less selling costs are very confident that this lower price can be achieved. Property B needed repair work carried out on it before a sale could be completed. This repair work was carried out in the two-week period beginning 10 April 2013. The costs of this repair work are reflected in the estimated fair value less costs to sell figure for property B of Rs18 Million (see above). This estimate remains valid. Required: Calculate the carrying values of both properties in the statement of financial position of Aumi at 31 March 2013 and the amounts charged to the statement of comprehensive income for the year ended 31 March 2013, with appropriate explanations of the treatments you have adopted. (8 marks] (d) On 1 January 2012 Millers Ltd opens a new factory and receives a government grant of R$15,000 in respect of capital equipment costing R$100,000. It depreciates all plant and machinery at 20% per annum straight-line. The policy of Millers Lid is to treat the grant as a deferred credit Page Required! Page 2. Show the Statement of Financial positibo Extractos in prespect of the asset and its relating to grands at 3pc Desbarber: 2012 Totil marks as Total marss 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts