Question: Can you please show me how to do these practice questions Suppose a firm is expected to increase dividends by 2056 in one year and

Can you please show me how to do these practice questions

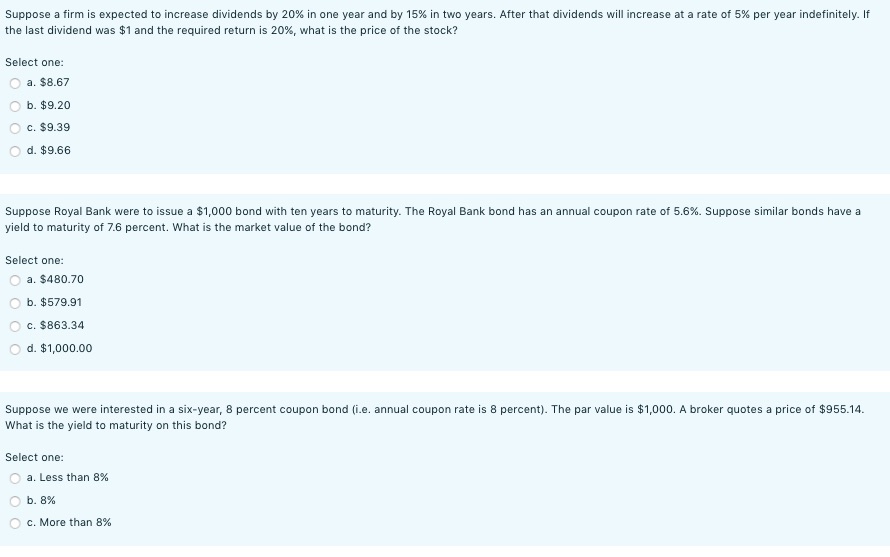

Suppose a firm is expected to increase dividends by 2056 in one year and by 1556 in two years. After that dividends will increase at a rate of 556 per year indefinitely. If the last dividend was $1 and the required return is 20%, what is the price of the std-ck? Select one: '_' a. $3.6? '_\" b.$9.2o 7 12.59.39 '_' d. $9.66 Suppose Royal Bank were to issue a $1,909 bond with ten years to maturity. The Royal Bank bond has an annual coupon rate of 5.5%. Suppose similar bonds have a yield to maturity of 16 percent. What is the market value oi the bond? Select one: \"_ a. $430.7\") '_' b.$5?9.91 f c.$363.34 f d. $1,ooo.nu Suppose we were interested in a six-year, 3 percent coupon bond {i_e. annual coupon rate is El percent}. The par value is 31,0013. A broker quotes a price of $955.14. What is the yield to maturity on this bond? Select one: '_\" a. Less than 3% '_\" b. 3% " c. More than 3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts