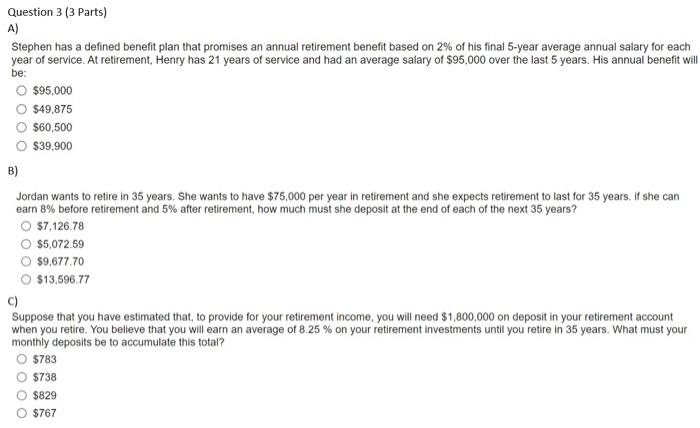

Question: Can you please show me how to do this question using a texas instruments BA Calc please Question 3 (3 Parts) A) Stephen has a

Question 3 (3 Parts) A) Stephen has a defined benefit plan that promises an annual retirement benefit based on 2% of his final 5-year average annual salary for each year of service At retirement, Henry has 21 years of service and had an average salary of $95.000 over the last 5 years. His annual benefit will be: $95,000 $49,875 $60,500 O $39.900 B) Jordan wants to retire in 35 years. She wants to have $75,000 per year in retirement and she expects retirement to last for 35 years. If she can earn 8% before retirement and 5% after retirement, how much must she deposit at the end of each of the next 35 years? O $7,126.78 O $5,072.59 O $9,677 70 $13,596.77 c) Suppose that you have estimated that, to provide for your retirement income, you will need $1,800,000 on deposit in your retirement account when you retire. You believe that you will earn an average of 8.25 % on your retirement investments until you retire in 35 years. What must your monthly deposits be to accumulate this total? $783 $738 $829 $767

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts