Question: can you please show the step by step solution. please do not skip steps. Please try to refrain from using Excel Problem # 7 :

can you please show the step by step solution. please do not skip steps. Please try to refrain from using Excel

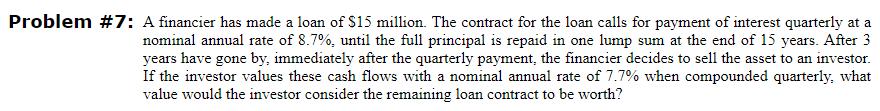

Problem #: A financier has made a loan of $ million. The contract for the loan calls for payment of interest quarterly at a

nominal annual rate of until the full principal is repaid in one lump sum at the end of years. After

years have gone by immediately after the quarterly payment, the financier decides to sell the asset to an investor.

If the investor values these cash flows with a nominal annual rate of when compounded quarterly, what

value would the investor consider the remaining loan contract to be worth?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock