Question: Can you please show your work or calculator steps? Problem 11-26 A 30-year maturity bond making annual coupon payments with a coupon rate of 15.3%

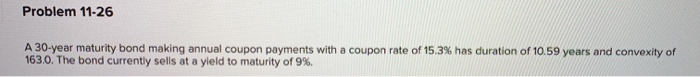

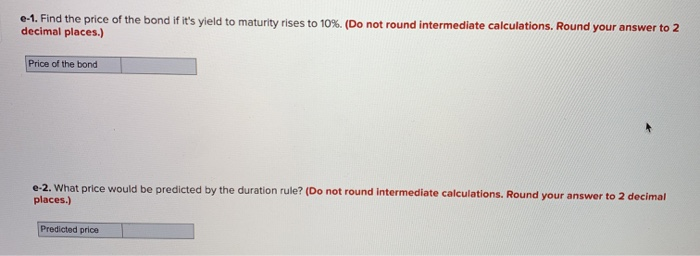

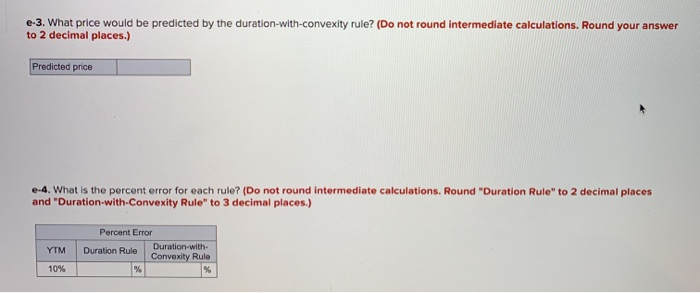

Problem 11-26 A 30-year maturity bond making annual coupon payments with a coupon rate of 15.3% has duration of 10.59 years and convexity of 163.0. The bond currently sells at a yield to maturity of 9% e-1. Find the price of the bond if it's yield to maturity rises to 10%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price of the bond e-2. What price would be predicted by the duration rule? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Predicted price e-3. What price would be predicted by the duration-with-convexity rule? (Do not round Intermediate calculations. Round your answer to 2 decimal places.) Predicted price e-4. What is the percent error for each rule? (Do not round intermediate calculations. Round "Duration Rule" to 2 decimal places and "Duration-with-Convexity Rule" to 3 decimal places.) Percent Error Duration Rule Duration Rule Duration with Convexity Rule YTM 10% e-5. Are your conclusions about the accuracy of the two rules consistent with parts (a) - (d)? Yes No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts