Question: Can you please show your work and/or calculator steps? Problem 11-26 A 30-year maturity bond making annual coupon payments with a coupon rate of 15.3%

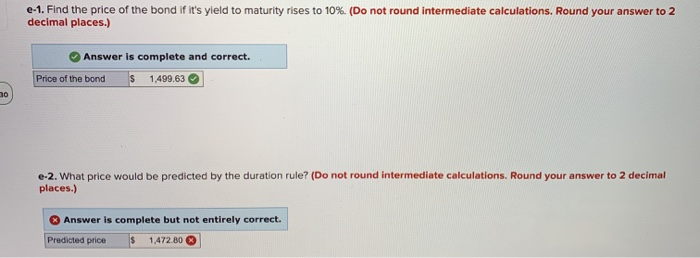

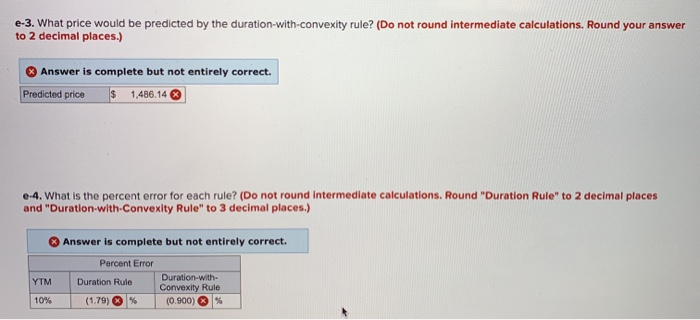

Problem 11-26 A 30-year maturity bond making annual coupon payments with a coupon rate of 15.3% has duration of 10.59 years and convexity of 163.0. The bond currently sells at a yield to maturity of 9%. e-1. Find the price of the bond if it's yield to maturity rises to 10%. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct. Price of the bond $ 1.499.63 e-2. What price would be predicted by the duration rule? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Predicted price $ 1,472.80 e-3. What price would be predicted by the duration-with-convexity rule? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Predicted price $ 1,486.14 e-4. What is the percent error for each rule? (Do not round intermediate calculations. Round "Duration Rule" to 2 decimal places and "Duration-with-Convexity Rule" to 3 decimal places.) Answer is complete but not entirely correct. Percent Error Duration-with- Duration Rule Convexity Rule (1.79) % (0.900) % YTM 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts