Question: Can you please solve and explain both using Excel, I included my work and im not sure where I went wrong with both part a

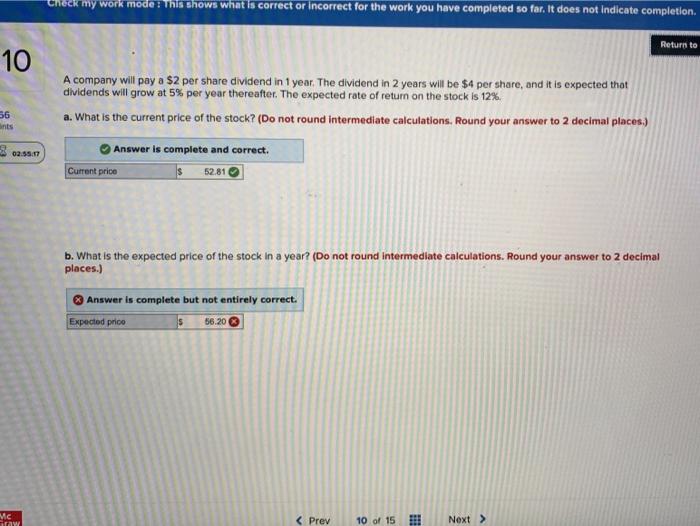

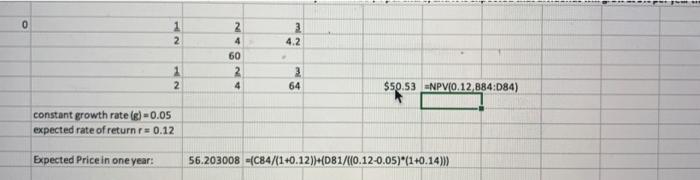

Check my work mode? This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to 10 A company will pay a $2 per share dividend in 1 year. The dividend in 2 years will be $4 per share, and it is expected that dividends will grow at 5% per year thereafter. The expected rate of return on the stock is 12% a. What is the current price of the stock? (Do not round intermediate calculations. Round your answer to 2 decimal places.) 56 nts 02:55 Answer is complete and correct. Current price $ $2,81 b. What is the expected price of the stock in a year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Expected price s 86.20 MC Taw 0 1 2 3 4.2 NSN 1 2 3 64 4 $50.53 NPV0.12,884:D84) constant growth rate (g) +0.05 expected rate of return r= 0.12 Expected Price in one year: 56.203008 =(C84/(1+0.12))H(DB1/((0.12-0.05)*(1+0.14)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts