Question: can you please solve the question without using excel? thank you Part 2 (Application) Suppose that you have to sell an asset (in pound unit)

can you please solve the question without using excel? thank you

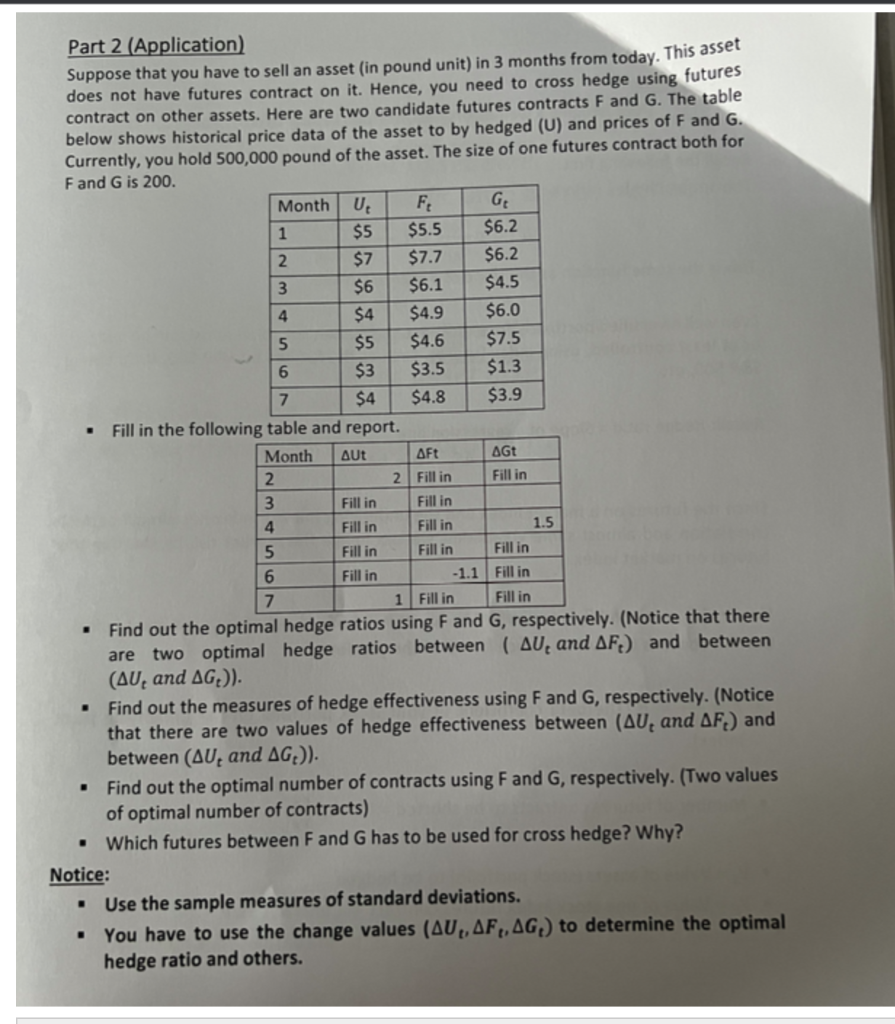

Part 2 (Application) Suppose that you have to sell an asset (in pound unit) in 3 months from today. This asset does not have futures contract on it. Hence, you need to cross hedge using futures contract on other assets. Here are two candidate futures contracts F and G. The table below shows historical price data of the asset to by hedged (U) and prices of F and G. Currently, you hold 500,000 pound of the asset. The size of one futures contract both for F and G is 200. - Fill in the following table and report. - Find out the optimal hedge ratios using F and G, respectively. (Notice that there are two optimal hedge ratios between (Ut and Ft) and between (Ut and Gt)). - Find out the measures of hedge effectiveness using F and G, respectively. (Notice that there are two values of hedge effectiveness between (Ut and Ft) and between (Ut and Gt)). - Find out the optimal number of contracts using F and G, respectively. (Two values of optimal number of contracts) - Which futures between F and G has to be used for cross hedge? Why? Notice: - Use the sample measures of standard deviations. - You have to use the change values (Ut,Ft,Gt) to determine the optimal hedge ratio and others

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts