Question: Can you please solve this question by setting standard deviation to 0. Please show steps, thanks! 12. Suppose that there are many stocks in the

Can you please solve this question by setting standard deviation to 0. Please show steps, thanks!

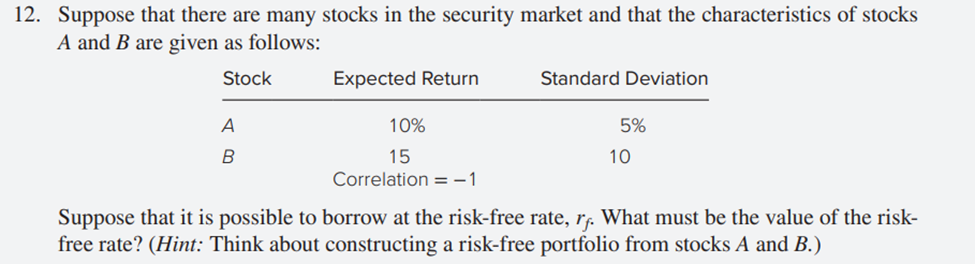

12. Suppose that there are many stocks in the security market and that the characteristics of stocks A and B are given as follows: Stock Expected Return Standard Deviation 10% 5% B 10 15 Correlation = -1 Suppose that it is possible to borrow at the risk-free rate, rf. What must be the value of the risk- free rate? (Hint: Think about constructing a risk-free portfolio from stocks A and B.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts