Question: Can you please thoroughly explain how to work this out, thank you. Q4. In late 2019, MedEquip, Inc. signed a contract with a local hospital

Can you please thoroughly explain how to work this out, thank you.

Can you please thoroughly explain how to work this out, thank you.

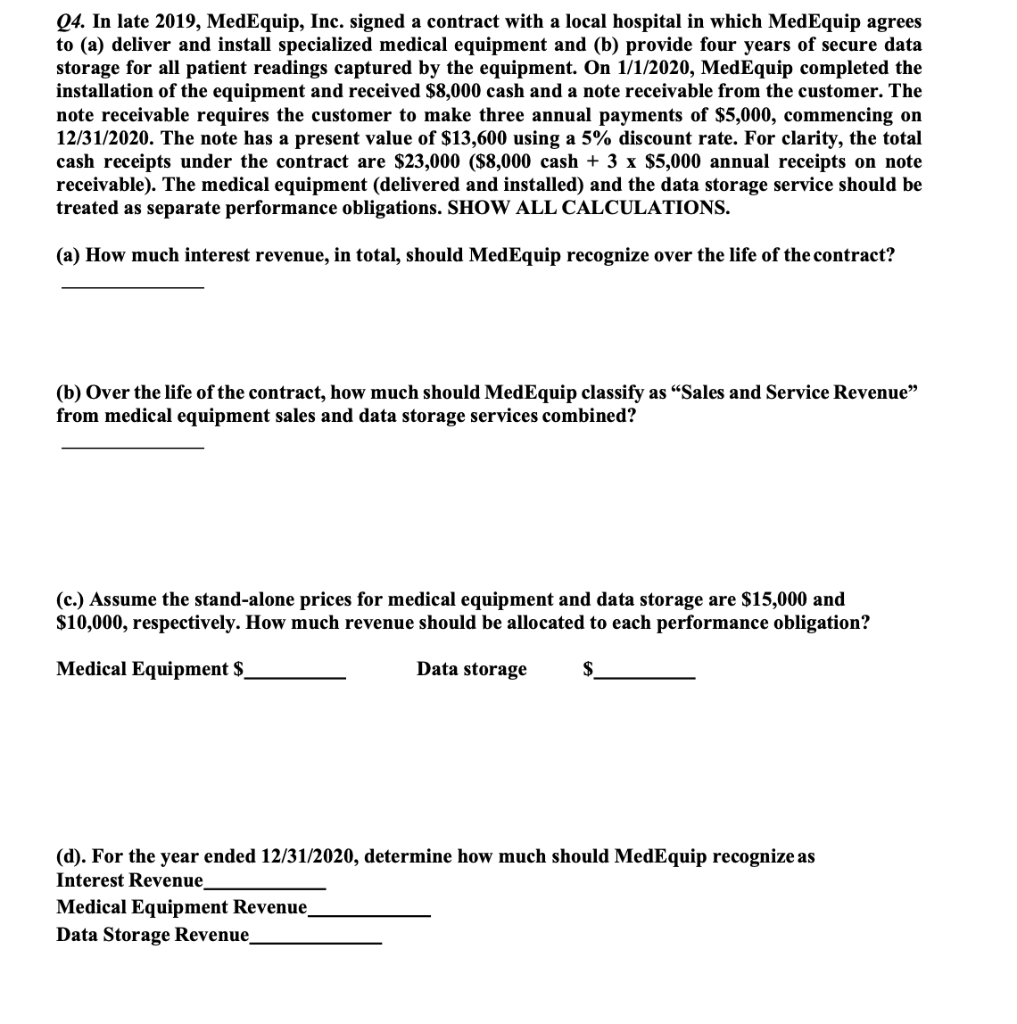

Q4. In late 2019, MedEquip, Inc. signed a contract with a local hospital in which MedEquip agrees to (a) deliver and install specialized medical equipment and (b) provide four years of secure data storage for all patient readings captured by the equipment. On 1/1/2020, MedEquip completed the installation of the equipment and received $8,000 cash and a note receivable from the customer. The note receivable requires the customer to make three annual payments of $5,000, commencing on 12/31/2020. The note has a present value of $13,600 using a 5% discount rate. For clarity, the total cash receipts under the contract are $23,000 ($8,000 cash + 3 x $5,000 annual receipts on note receivable). The medical equipment (delivered and installed) and the data storage service should be treated as separate performance obligations. SHOW ALL CALCULATIONS. (a) How much interest revenue, in total, should MedEquip recognize over the life of the contract? (b) Over the life of the contract, how much should MedEquip classify as Sales and Service Revenue from medical equipment sales and data storage services combined? (c.) Assume the stand-alone prices for medical equipment and data storage are $15,000 and $10,000, respectively. How much revenue should be allocated to each performance obligation? Medical Equipment $ Data storage (d). For the year ended 12/31/2020, determine how much should MedEquip recognize as Interest Revenue Medical Equipment Revenue Data Storage Revenue_

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts