Question: can you plese explain how to do it what are u mean can u do it A portfolio consists of three stocks: Stock A, Stock

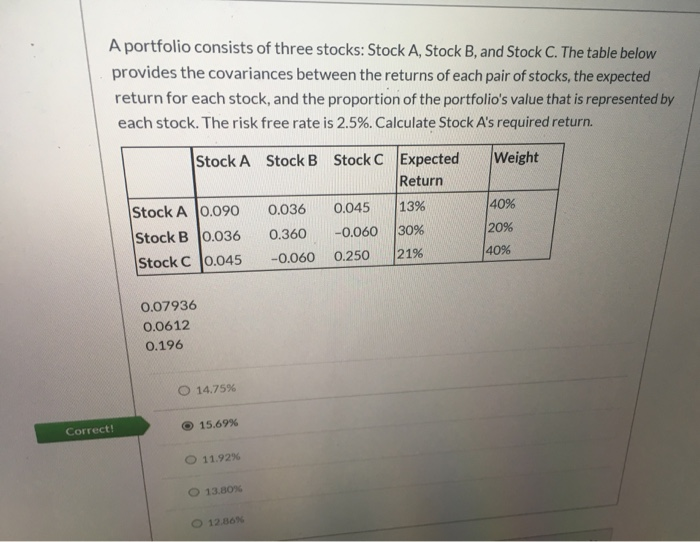

A portfolio consists of three stocks: Stock A, Stock B, and Stock C. The table below provides the covariances between the returns of each pair of stocks, the expected return for each stock, and the proportion of the portfolio's value that is represented by each stock. The risk free rate is 2.5%. Calculate Stock A's required return. Stock A Stock B Stock C Weight Expected Return 13% 30% Stock A 0.090 Stock B 10.036 Stock C 0.045 0.036 0.360 -0.060 0.045 -0.060 0.250 40% 20% 40% 21% 0.07936 0.0612 0.196 14.75% Correct! 15.69% O 11.92% 13.80% O 12.86% A portfolio consists of three stocks: Stock A, Stock B, and Stock C. The table below provides the covariances between the returns of each pair of stocks, the expected return for each stock, and the proportion of the portfolio's value that is represented by each stock. The risk free rate is 2.5%. Calculate Stock A's required return. Stock A Stock B Stock C Weight Expected Return 13% 30% Stock A 0.090 Stock B 10.036 Stock C 0.045 0.036 0.360 -0.060 0.045 -0.060 0.250 40% 20% 40% 21% 0.07936 0.0612 0.196 14.75% Correct! 15.69% O 11.92% 13.80% O 12.86%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts