Question: can you provide a step by step solution for question 1 to question 6 please You are responsible for pricing a book of business which

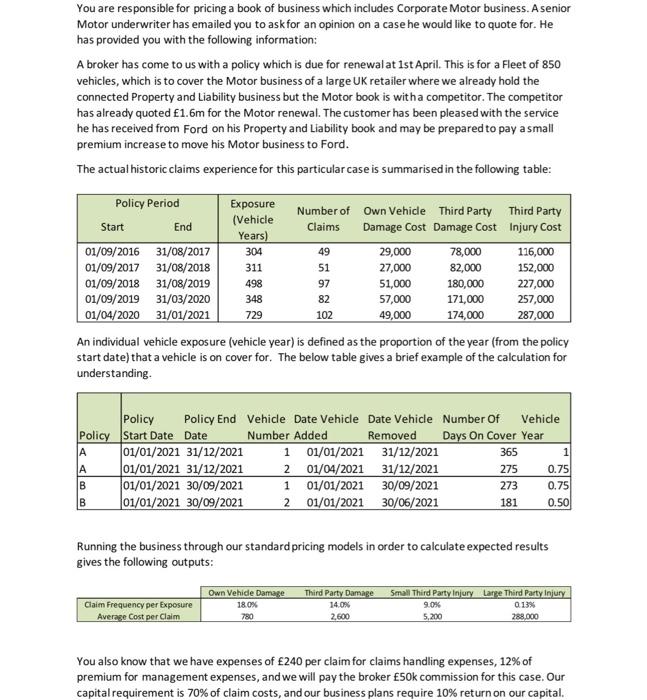

You are responsible for pricing a book of business which includes Corporate Motor business. A senior Motor underwriter has emailed you to ask for an opinion on a case he would like to quote for. He has provided you with the following information: A broker has come to us with a policy which is due for renewal at 1st April. This is for a Fleet of 850 vehicles, which is to cover the Motor business of a large UK retailer where we already hold the connected Property and Liability business but the Motor book is with a competitor. The competitor has already quoted 1.6m for the Motor renewal. The customer has been pleased with the service he has received from Ford on his Property and Liability book and may be prepared to pay a small premium increase to move his Motor business to Ford. The actual historic claims experience for this particular case is summarised in the following table: Policy Period Exposure Number of Own Vehicle Third Party Third Party Start End (Vehicle Claims Years) Damage Cost Damage Cost Injury Cost 01/09/2016 31/08/2017 304 49 29,000 78,000 116,000 01/09/2017 31/08/2018 311 51 27,000 82,000 152,000 01/09/2018 31/08/2019 498 97 51,000 180,000 227,000 01/09/2019 31/03/2020 82 57,000 171,000 257,000 01/04/2020 31/01/2021 729 102 49,000 174,000 287,000 An individual vehicle exposure (vehicle year) is defined as the proportion of the year (from the policy start date) that a vehicle is on cover for. The below table gives a brief example of the calculation for understanding 348 365 1 Policy Policy End Vehicle Date Vehicle Date Vehicle Number of vehicle Policy Start Date Date Number Added Removed Days On Cover Year A 01/01/2021 31/12/2021 1 01/01/2021 31/12/2021 01/01/2021 31/12/2021 2 01/04/2021 31/12/2021 275 0.75 01/01/2021 30/09/2021 1 01/01/2021 30/09/2021 273 0.75 01/01/2021 30/09/2021 2 01/01/2021 30/06/2021 181 0.50 B B Running the business through our standard pricing models in order to calculate expected results gives the following outputs: Claim Frequency per Exposure Average Cost per Claim Own Vehide Damage 18.0% 780 Third Party Damage 14.08 2.600 Small Third Party Injury Larpe Third Party Injury 9.0% 0.13% 5,200 288.000 You also know that we have expenses of 240 per claim for claims handling expenses, 12% of premium for management expenses, and we will pay the broker 50k commission for this case. Our capital requirement is 70% of claim costs, and our business plans require 10% return on our capital. Questions Please prepare a presentation that covers the following: What do you think the expected claim cost is per vehicle, according to our pricing models? How does this compare to the actual claims experience observed over the last 5 years? What do you think might explain any discrepancy? . Are there any clear trends in the risk, or in the claims experience, over the last 5 years? What do you think might have caused these? What would be your estimate of the claims cost for the coming year? How much premium do you think we should charge for the risk? Do you think we can be competitive with the price the competitor is offering? Is there any further information you would require before making a final recommendation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts