Question: please answer all 4 questions with there required Unit 4- PART A Question 1: a. The Flora Book Shop's cash book shows the positive bank

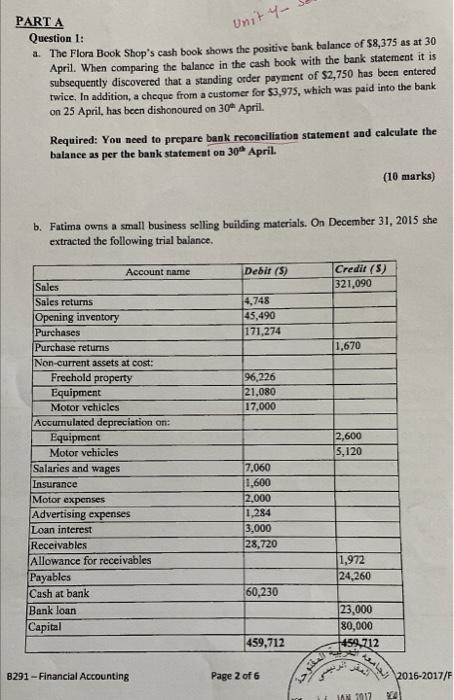

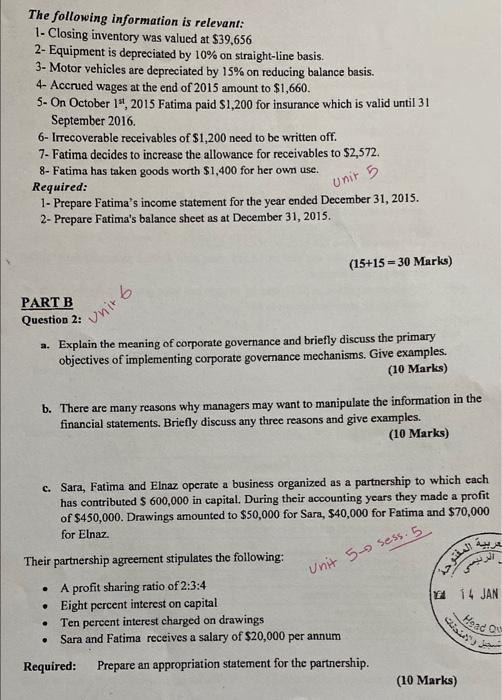

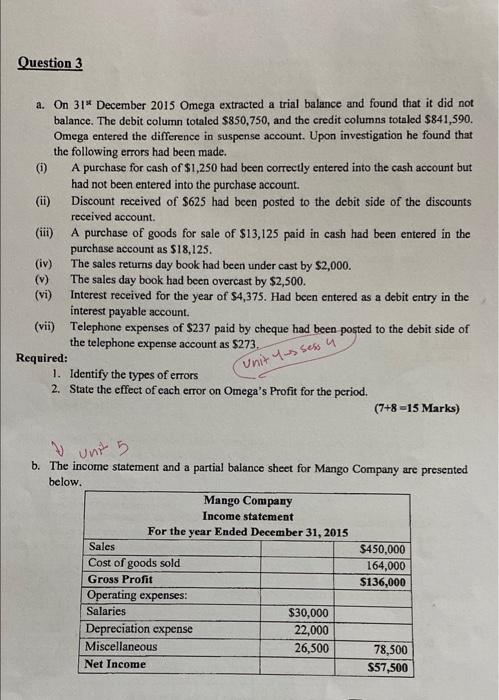

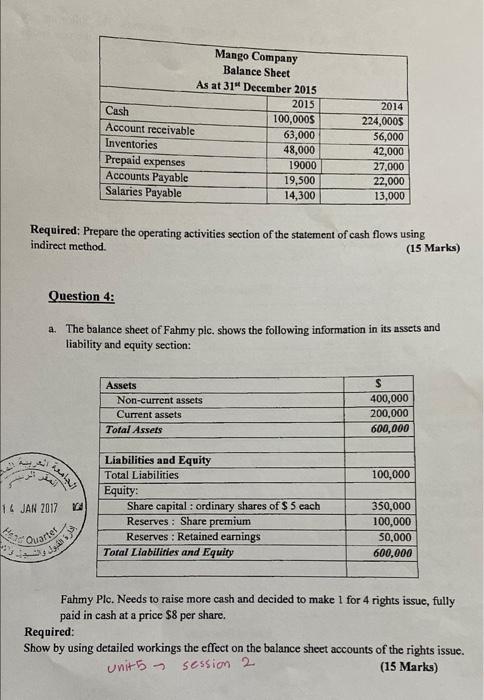

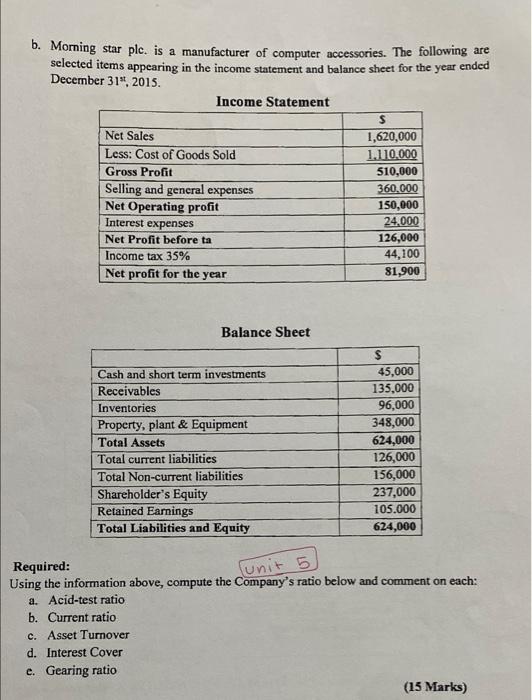

Unit 4- PART A Question 1: a. The Flora Book Shop's cash book shows the positive bank balance of 58,375 as at 30 April. When comparing the balance in the cash book with the bank statement it is subsequently discovered that a standing order payment of $2,750 has been entered twice. In addition, a cheque from a customer for $3,975, which was paid into the bank on 25 April, has been dishonoured on 30 April. Required: You need to prepare bank reconciliation statement and calculate the balance as per the bank statement on 30 April. (10 marks) b. Fatima owns a small business selling building materials. On December 31, 2015 she extracted the following trial balance. Debit (5) Credit (5) 321,090 4,748 45,490 171,274 1.670 96,226 21.080 17,000 Account name Sales Sales returns Opening inventory Purchases Purchase returns Non-current assets at cost: Freehold property Equipment Motor vehicles Accumulated depreciation on: Equipment Motor vehicles Salaries and wages Insurance Motor expenses Advertising expenses Loan interest Receivables Allowance for receivables Payables Cash at bank Bank loan Capital 2,600 5,120 7,060 11.600 2.000 1,284 3,000 28,720 1,972 24,260 60,230 23,000 80,000 459,712 459 B291 - Financial Accounting Page 2 of 6 2016-2017/F IAN 2017 2 The following information is relevant: 1- Closing inventory was valued at $39,656 2- Equipment is depreciated by 10% on straight-line basis. 3- Motor vehicles are depreciated by 15% on reducing balance basis. 4- Accrued wages at the end of 2015 amount to $1,660. 5- On October 19, 2015 Fatima paid $1,200 for insurance which is valid until 31 September 2016 6- Irrecoverable receivables of $1,200 need to be written off. 7- Fatima decides to increase the allowance for receivables to $2,572. 8- Fatima has taken goods worth $1,400 for her own use. Required: 1- Prepare Fatima's income statement for the year ended December 31, 2015. 2- Prepare Fatima's balance sheet as at December 31, 2015. Unit 5 (15+15 - 30 Marks) Unit 6 PARTB Question 2: a. Explain the meaning of corporate governance and briefly discuss the primary objectives of implementing corporate governance mechanisms. Give examples. (10 Marks) b. There are many reasons why managers may want to manipulate the information in the financial statements. Briefly discuss any three reasons and give examples. (10 Marks) c. Sara, Fatima and Elnaz operate a business organized as a partnership to which cach has contributed $ 600,000 in capital. During their accounting years they made a profit of $450,000. Drawings amounted to $50,000 for Sara, $40,000 for Fatima and $70,000 for Elnaz. Unit 5. sess. 5 . 14 JAN Their partnership agreement stipulates the following: A profit sharing ratio of 2:3:4 Eight percent interest on capital Ten percent interest charged on drawings Sara and Fatima receives a salary of $20,000 per annum Required: Prepare an appropriation statement for the partnership. . eac . (10 Marks) Question 3 a. On 31 December 2015 Omega extracted a trial balance and found that it did not balance. The debit column totaled $850,750, and the credit columns totaled $841,590. Omega entered the difference in suspense account. Upon investigation he found that the following errors had been made. 0 A purchase for cash of $1,250 had been correctly entered into the cash account but had not been entered into the purchase account. (ii) Discount received of $625 had been posted to the debit side of the discounts received account. (iii) A purchase of goods for sale of $13,125 paid in cash had been entered in the purchase account as $18,125. (iv) The sales returns day book had been under cast by $2,000. (v) The sales day book had been overcast by $2,500. (vi) Interest received for the year of $4,375. Had been entered as a debit entry in the interest payable account. (vii) Telephone expenses of $237 paid by cheque had been posted to the debit side of the telephone expense account as $273. Required: 1. Identify the types of errors 2. State the effect of each error on Omega's Profit for the period. (7+8 -15 Marks) Unit 4 sess u V unt 5 b. The income statement and a partial balance sheet for Mango Company are presented below. Mango Company Income statement For the year Ended December 31, 2015 Sales $450,000 Cost of goods sold 164,000 Gross Profit $136,000 Operating expenses: Salaries $30,000 Depreciation expense 22,000 Miscellaneous 26,500 78,500 Net Income $57,500 Mango Company Balance Sheet As at 31 December 2015 Cash Account receivable Inventories Prepaid expenses Accounts Payable Salaries Payable 2015 100,000$ 63,000 48,000 19000 19,500 14,300 2014 224,0005 56,000 42,000 27,000 22,000 13,000 Required: Prepare the operating activities section of the statement of cash flows using indirect method (15 Marks) Question 4: a. The balance sheet of Fahmy plc. shows the following information in its assets and liability and equity section: Assets Non-current assets Current assets Total Assets S 400,000 200,000 600,000 aastat 100,000 14 JAN 2017 Liabilities and Equity Total Liabilities Equity: Share capital : ordinary shares of $ 5 each Reserves : Share premium Reserves : Retained earnings Toral Liabilities and Equity Het 03 350,000 100,000 50,000 600,000 Quarter Fahmy Plc. Needs to raise more cash and decided to make 1 for 4 rights issue, fully paid in cash at a price $8 per share. Required: Show by using detailed workings the effect on the balance sheet accounts of the rights issue. unit 5 session 2 (15 Marks) b. Morning star plc. is a manufacturer of computer accessories. The following are selected items appearing in the income statement and balance sheet for the year ended December 31". 2015. Income Statement $ Net Sales 1,620,000 Less: Cost of Goods Sold 1.110.000 Gross Profit 510,000 Selling and general expenses 360,000 Net Operating profit 150,000 Interest expenses 24,000 Net Profit before ta 126,000 Income tax 35% 44,100 Net profit for the year 81,900 Balance Sheet Cash and short term investments Receivables Inventories Property, plant & Equipment Total Assets Total current liabilities Total Non-current liabilities Shareholder's Equity Retained Earnings Total Liabilities and Equity $ 45,000 135,000 96,000 348,000 624,000 126,000 156,000 237,000 105.000 624,000 unit 5 Required: Using the information above, compute the Company's ratio below and comment on each: a. Acid-test ratio b. Current ratio c. Asset Turnover d. Interest Cover e. Gearing ratio (15 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts