Question: can you show me how to do problems 9-3 & 9-8. thanks utis tie of the project to Zebra? (b) If Leopard Fashions evaluates the

can you show me how to do problems 9-3 & 9-8. thanks

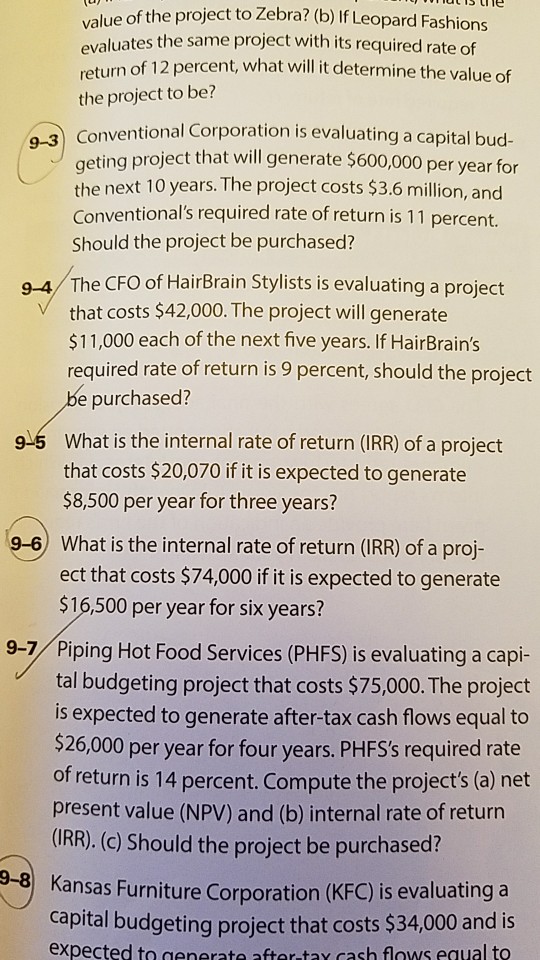

utis tie of the project to Zebra? (b) If Leopard Fashions evaluates the same project with its required rate of of 12 percent, what will it determine the value of retur the project to be? Conventional Corporation is evaluating a capital bud- geting project that will generate $600,000 per year for the next 10 years. The project costs $3.6 million, and Conventional's required rate of return is 11 percent. Should the project be purchased? 9-4 The CFO of HairBrain Stylists is evaluating a project V that costs $42,000. The project will generate $11,000 each of the next five years. If HairBrain's required rate of return is 9 percent, should the project be purchased? What is the internal rate of return (IRR) of a project that costs $20,070 if it is expected to generate $8,500 per year for three years? 915 9-6 What is the internal rate of return (IRR) of a proj- ect that costs $74,000 if it is expected to generate $16,500 per year for six years? 9-7 Piping Hot Food Services (PHFS) is evaluating a capi- tal budgeting project that costs $75,000. The project is expected to generate after-tax cash flows equal to $26,000 per year for four years. PHFSs required rate of return is 14 percent. Compute the project's (a) net present value (NPV) and (b) internal rate of return (IRR).(c) Should the project be purchased? 9 -8 Kansas Furniture Corporation (KFC) is evaluating a capital budgeting project that costs $34,000 and is expected to generate aftar-tay cash flows equal to utis tie of the project to Zebra? (b) If Leopard Fashions evaluates the same project with its required rate of of 12 percent, what will it determine the value of retur the project to be? Conventional Corporation is evaluating a capital bud- geting project that will generate $600,000 per year for the next 10 years. The project costs $3.6 million, and Conventional's required rate of return is 11 percent. Should the project be purchased? 9-4 The CFO of HairBrain Stylists is evaluating a project V that costs $42,000. The project will generate $11,000 each of the next five years. If HairBrain's required rate of return is 9 percent, should the project be purchased? What is the internal rate of return (IRR) of a project that costs $20,070 if it is expected to generate $8,500 per year for three years? 915 9-6 What is the internal rate of return (IRR) of a proj- ect that costs $74,000 if it is expected to generate $16,500 per year for six years? 9-7 Piping Hot Food Services (PHFS) is evaluating a capi- tal budgeting project that costs $75,000. The project is expected to generate after-tax cash flows equal to $26,000 per year for four years. PHFSs required rate of return is 14 percent. Compute the project's (a) net present value (NPV) and (b) internal rate of return (IRR).(c) Should the project be purchased? 9 -8 Kansas Furniture Corporation (KFC) is evaluating a capital budgeting project that costs $34,000 and is expected to generate aftar-tay cash flows equal to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts