Question: Can you show me how to solve this question step by step in an easy way. Saw that this question have alredy been posted but

Can you show me how to solve this question step by step in an easy way. Saw that this question have alredy been posted but i din not underastn where exctly they got the discount rate from at all QUESTION

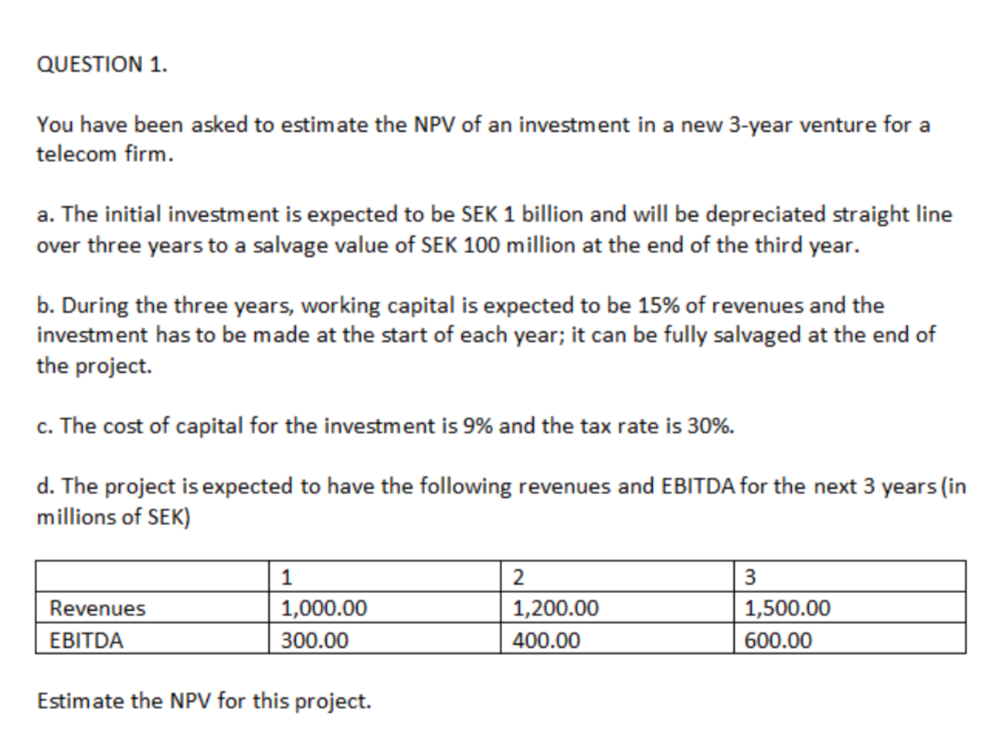

You have been asked to estimate the NPV of an investment in a new year venture for a

telecom firm.

a The initial investment is expected to be SEK billion and will be depreciated straight line

over three years to a salvage value of SEK million at the end of the third year.

b During the three years, working capital is expected to be of revenues and the

investment has to be made at the start of each year; it can be fully salvaged at the end of

the project.

c The cost of capital for the investment is and the tax rate is

d The project is expected to have the following revenues and EBITDA for the next years in

millions of SEK

Estimate the NPV for this project.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock