Question: Can you show the answer also the steps for question B and question C and the consolidated earnings per share after each question NexusTech currently

Can you show the answer also the steps for question B and question C and the consolidated earnings per share after each question

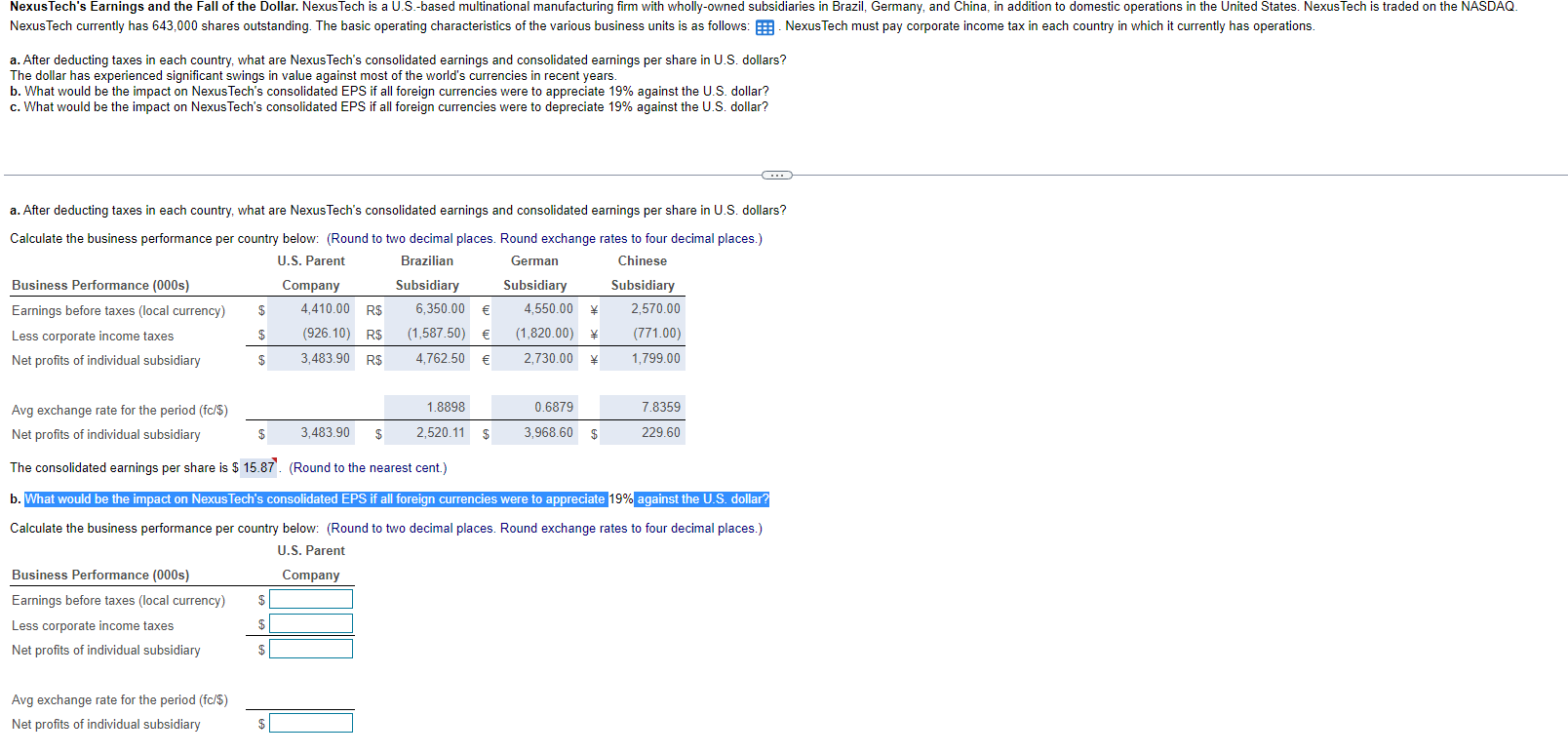

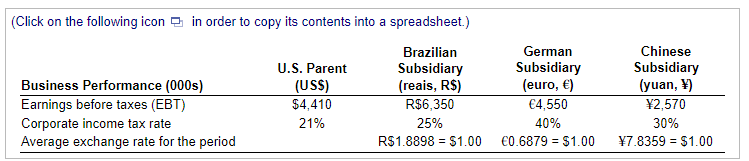

NexusTech currently has 643,000 shares outstanding. The basic operating characteristics of the various business units is as follows: NexusTech must pay corporate income tax in each country in which it currently has operations. a. After deducting taxes in each country, what are NexusTech's consolidated earnings and consolidated earnings per share in U.S. dollars? The dollar has experienced significant swings in value against most of the world's currencies in recent years. b. What would be the impact on NexusTech's consolidated EPS if all foreign currencies were to appreciate 19% against the U.S. dollar? c. What would be the impact on NexusTech's consolidated EPS if all foreign currencies were to depreciate 19% against the U.S. dollar? a. After deducting taxes in each country, what are NexusTech's consolidated earnings and consolidated earnings per share in U.S. dollars? Calculate the business performance per country below: (Round to two decimal places. Round exchange rates to four decimal places.) Avg excnange rate tor the period (TC/\$) - Net profits of individual subsidiary $$29.60t.usus The consolidated earnings per share is $15.87. (Round to the nearest cent.) b. What would be the impact on NexusTech's consolidated EPS if all foreign currencies were to appreciate 19% Calculate the business performance per country below: (Round to two decimal places. Round exchange rates to four decimal places.) (Click on the following icon in order to copy its contents into a spreadsheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts