Question: can you solve b. c. d. e. Problem 12-20 Question Help Your firm is planning to invest in an automated packaging plant Harburtin Industries is

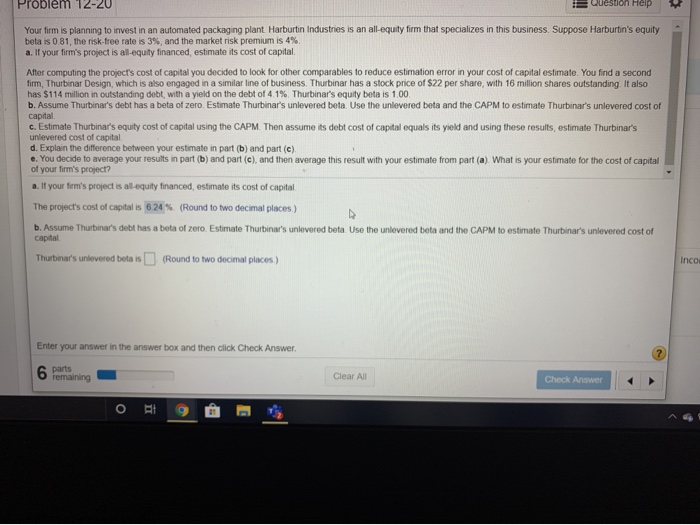

Problem 12-20 Question Help Your firm is planning to invest in an automated packaging plant Harburtin Industries is an all-equity firm that specializes in this business. Suppose Harburtin's equity beta is 0.81, the risk-free rate is 3%, and the market risk premium is 4% a. If your firm's project is all-equity financed, estimate its cost of capital After computing the project's cost of capital you decided to look for other comparables to reduce estimation error in your cost of capital estimate. You find a second firm, Thurbinar Design, which is also engaged in a similar line of business. Thurbinar has a stock price of $22 per share, with 16 million shares outstanding. It also has $114 million in outstanding debt, with a yield on the debt of 4 1% Thurbinar's equity beta is 1.00 b. Assume Thurbinar's debt has a beta of zero. Estimate Thurbinar's unlevered beta Use the unlevered beta and the CAPM to estimate Thurbinar's unlevered cost of capital c. Estimate Thurbinar's equity cost of capital using the CAPM. Then assume its debt cost of capital equals its yield and using these results, estimate Thurbinar's unlevered cost of capital d. Explain the difference between your estimate in part (b) and part (c) e. You decide to average your results in part (b) and part (c), and then average this result with your estimate from part (a). What is your estimate for the cost of capital of your firm's project? a. If your firm's project is all-equity financed, estimate its cost of capital The project's cost of capital is 6 24 % (Round to two decimal places) b. Assume Thurbinar's debt has a beta of zero. Estimate Thurbinar's unlovered beta. Use the unlevered bets and the CAPM to estimate Thurbinar's unlevered cost of capital Thurbinar's unlevered beta is (Round to two decimal places) Inco Enter your answer in the answer box and then click Check Answer. 6 Parts remaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts