Question: Please solve the following (For the first question, I already did part a. please do part b, thank you) the bond, a. what cash flows

Please solve the following (For the first question, I already did part a. please do part b, thank you)

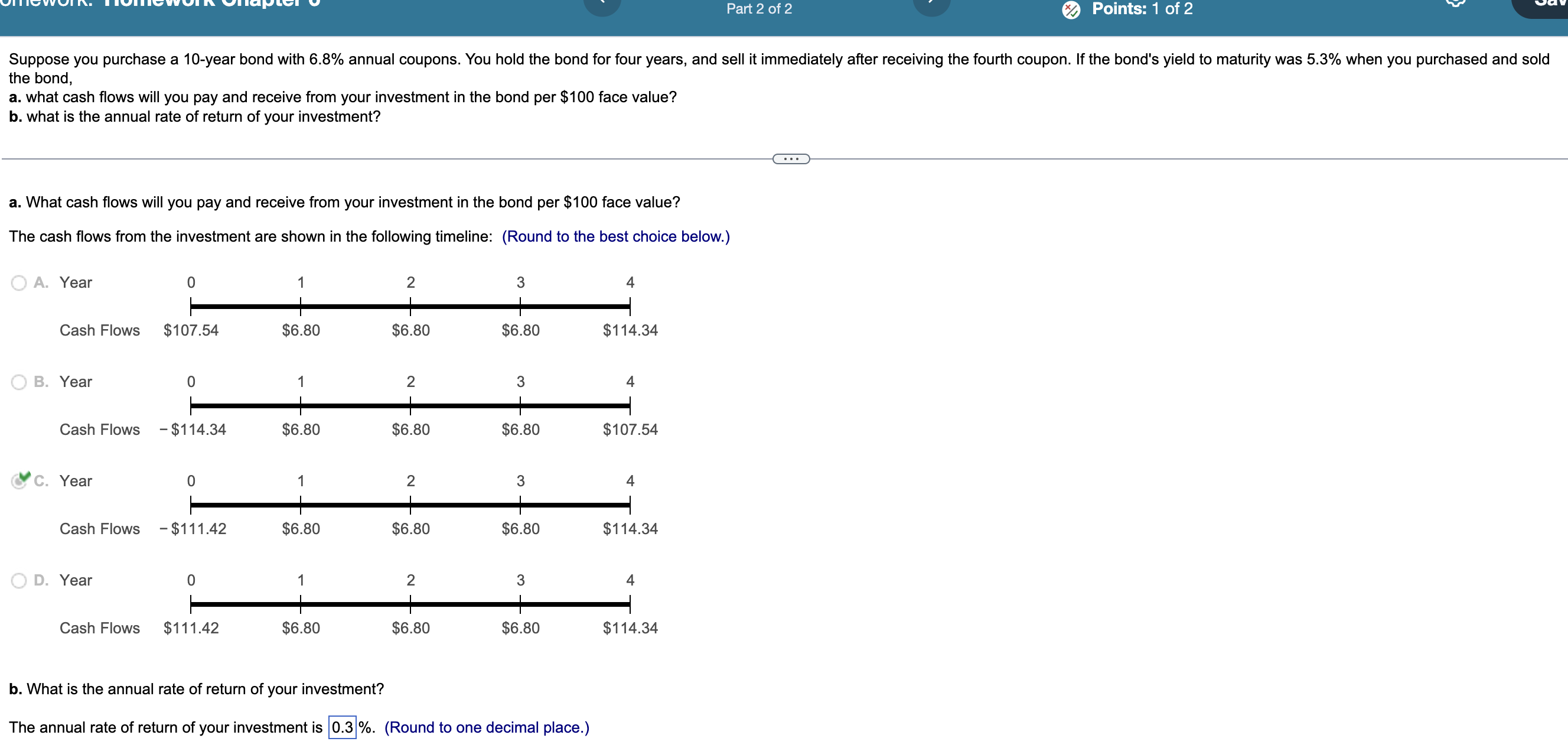

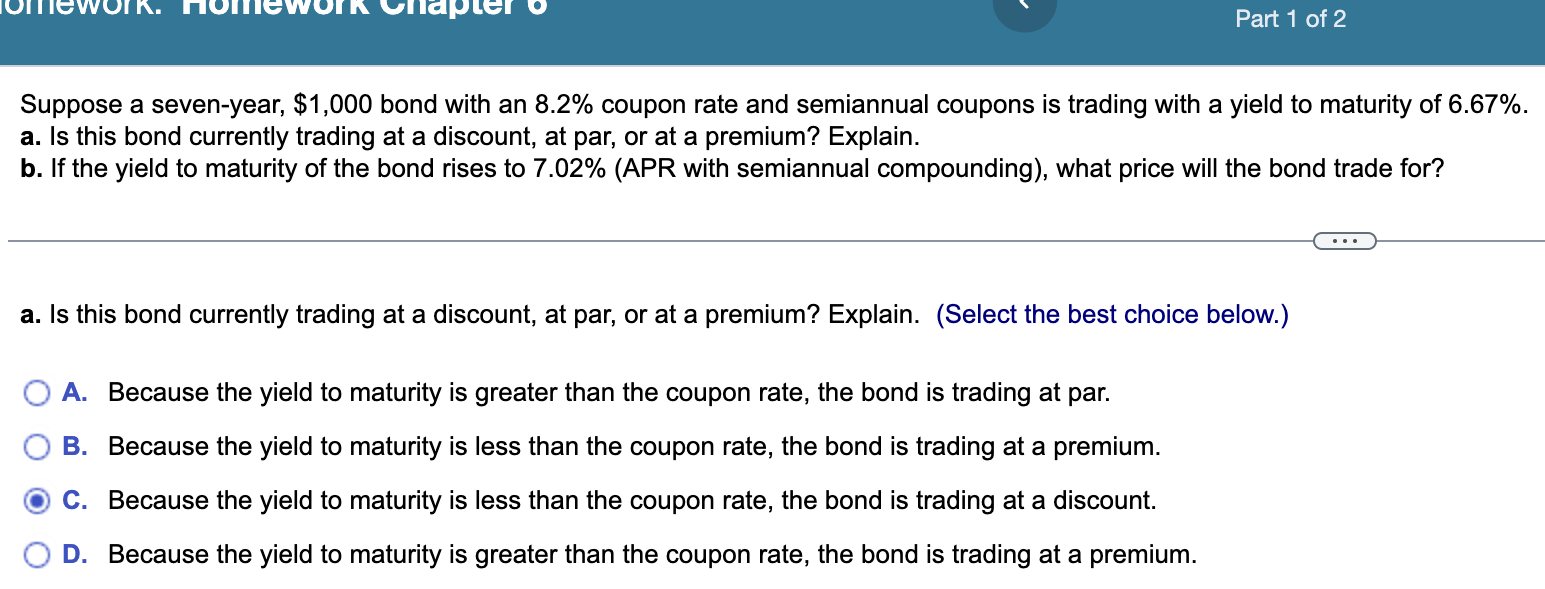

the bond, a. what cash flows will you pay and receive from your investment in the bond per $100 face value? b. what is the annual rate of return of your investment? a. What cash flows will you pay and receive from your investment in the bond per $100 face value? The cash flows from the investment are shown in the followina timeline: (Round to the best choice below.) b. What is the annual rate of return of your investment? The annual rate of return of your investment is 0.3%. (Round to one decimal place.) Suppose a seven-year, $1,000 bond with an 8.2% coupon rate and semiannual coupons is trading with a yield to maturity of 6.67%. a. Is this bond currently trading at a discount, at par, or at a premium? Explain. b. If the yield to maturity of the bond rises to 7.02% (APR with semiannual compounding), what price will the bond trade for? a. Is this bond currently trading at a discount, at par, or at a premium? Explain. (Select the best choice below.) A. Because the yield to maturity is greater than the coupon rate, the bond is trading at par. B. Because the yield to maturity is less than the coupon rate, the bond is trading at a premium. C. Because the yield to maturity is less than the coupon rate, the bond is trading at a discount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts