Question: Can you solve based this example? You have been hired to value a new 30-year, callable, convertible bond. The bond has a 6.90 percent coupon

Can you solve based this example? You have been hired to value a new 30-year, callable, convertible bond. The bond has a 6.90 percent coupon rate, payable annually. The conversion price is $151, and the stock currently sells for $36.50. The stock price is expected to grow at 12 percent per year. The bond is callable at $1,160, but based on prior experience, it won't be called unless the conversion value is $1,260. The required return on this bond is 9 percent. What value would you assign to this bond? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Bond value

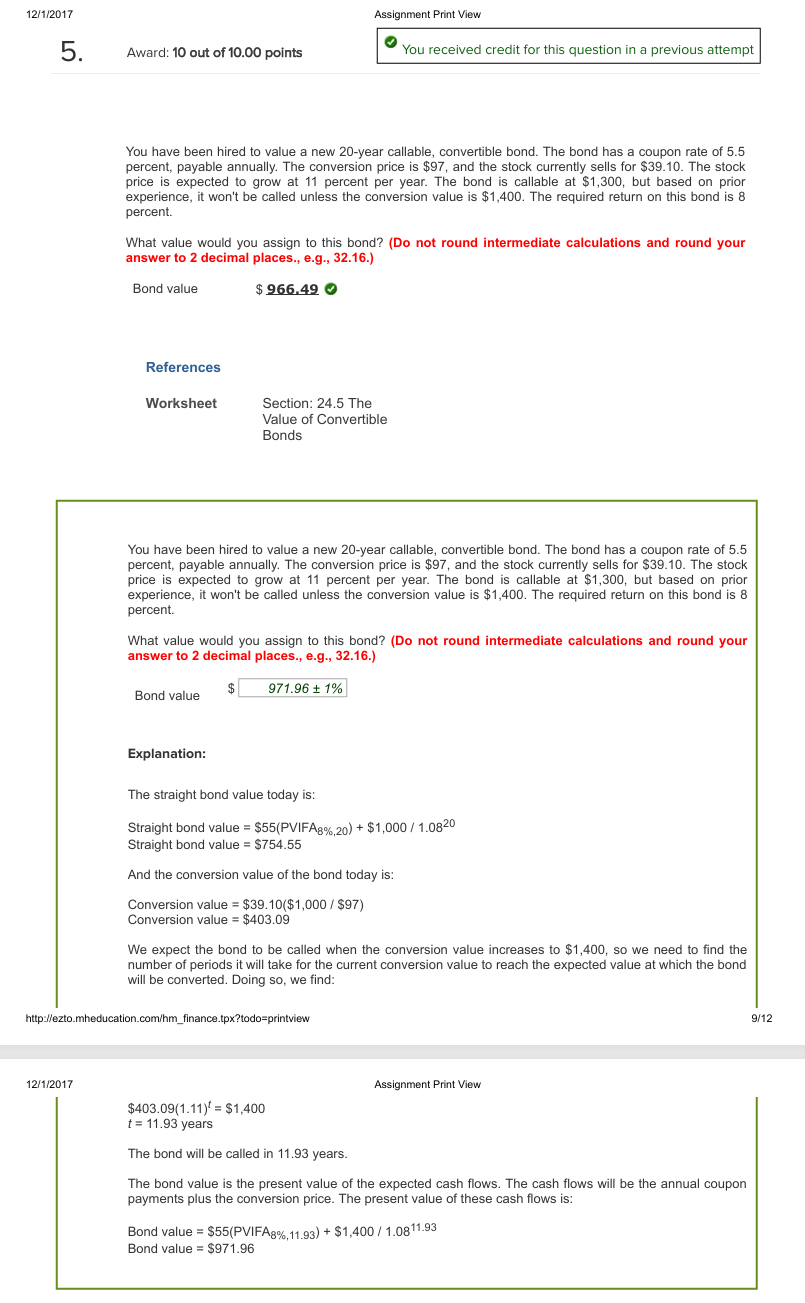

12/1/2017 5. Assignment Print View Award: 10 out of 10.00 points You received credit for this question in a previous attempt You have been hired to value a new 20-year callable, convertible bond. The bond has a coupon rate of 5.5 percent, payable annually. The conversion price is $97, and the stock currently sells for $39.10. The stock price is expected to grow at 11 percent per year. The bond is callable at $1,300, but based on prior experience, it won't be called unless the conversion value is $1,400. The required return on this bond is 8 percent. What value would you assign to this bond? (Do not round intermediate calculations and round your answer to 2 decimal places., e.g., 32.16.) Bond value $966.49 References Worksheet Section: 24.5 The Value of Convertible Bonds. You have been hired to value a new 20-year callable, convertible bond. The bond has a coupon rate of 5.5 percent, payable annually. The conversion price is $97, and the stock currently sells for $39.10. The stock price is expected to grow at 11 percent per year. The bond is callable at $1,300, but based on prior experience, it won't be called unless the conversion value is $1,400. The required return on this bond is 8 percent. What value would you assign to this bond? (Do not round intermediate calculations and round your answer to 2 decimal places., e.g., 32.16.) Bond value 27196 2 176) Explanation: The straight bond value today is: Straight bond value = $55(PVIFAge, 29) + $1,000 / 7.0870 Straight bond value = $754.55 And the conversion value of the band today is: Conversion value = $39.10($1,000 / $97) Conversion value = $403.09 We expect the bond to be called when the conversion value increases to $1,400, so we need to find the number of periods it will take for the current conversion value to reach the expected value at which the bond will be converted. Doing so, we find: hittpsezto_mheducation.cam/hm_finance.tpx?tedo=printview 12/1/2017 Assignment Print View $403.09(1.11)' = $1,400 t= 11.93 years The bond will be called in 11.93 years. The bond value is the present value of the expected cash flows. The cash flows will be the annual coupon payments plus the conversion price. The present value of these cash flows is: Bond value = $55(PVIFAgs, 44.93) + $1,400 / 1.081185 Bond value = $971.96 a2