Question: can you solve the two questions separately ? 9. Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of

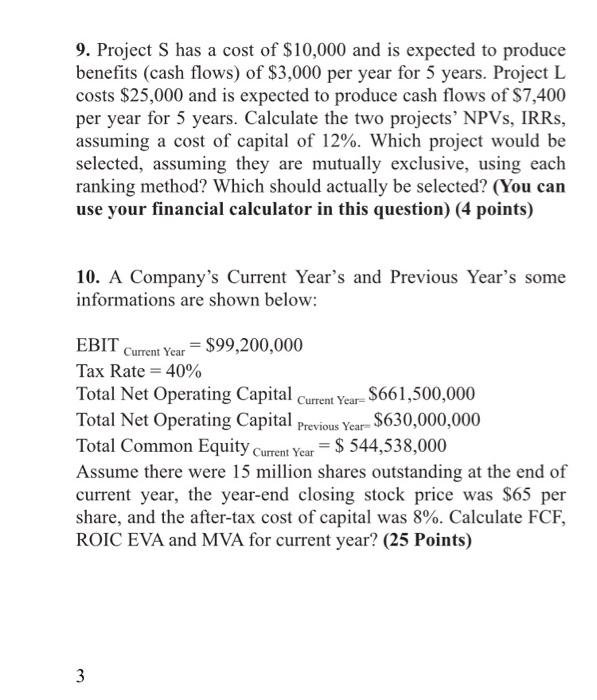

9. Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,400 per year for 5 years. Calculate the two projects' NPVS, IRRs, assuming a cost of capital of 12%. Which project would be selected, assuming they are mutually exclusive, using each ranking method? Which should actually be selected? (You can use your financial calculator in this question) (4 points) 10. A Company's Current Year's and Previous Year's some informations are shown below: EBIT Current Year = $99,200,000 Tax Rate = 40% Total Net Operating Capital Current Year- $661,500,000 Total Net Operating Capital Previous Year- $630,000,000 Total Common Equity Current Year = $ 544,538,000 Assume there were 15 million shares outstanding at the end of current year, the year-end closing stock price was $65 per share, and the after-tax cost of capital was 8%. Calculate FCF, ROIC EVA and MVA for current year? (25 Points) 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts