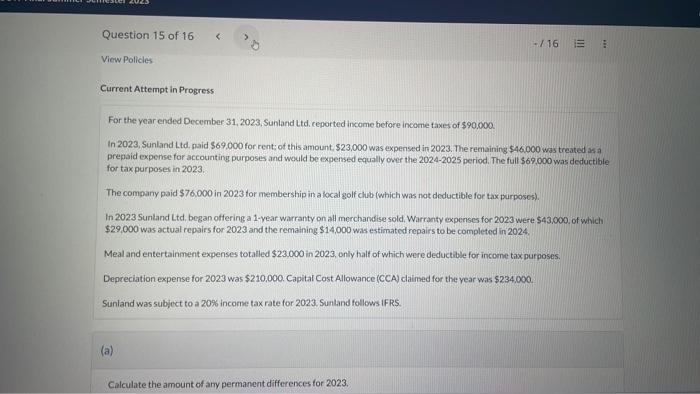

Question: Can you solve this for intermediate accounting For the year ended December 31, 2023, Sunland Ltd, ceported income before income taxes of ( $ 90,000

For the year ended December 31, 2023, Sunland Ltd, ceported income before income taxes of \\( \\$ 90,000 \\) In 2023, Sunland Ltd, paid \\( \\$ 69,000 \\) for rent; of this amount \\( \\$ 23,000 \\) was expensed in 2023 . The remaining \\( \\$ 46,000 \\) was treated ss a prepaid experise for accounting purposes and would be expensed equally over the \\( 2024-2025 \\) period. The full \\( \\$ 69,000 \\) was deductible for tax purposes in 2023. The company paid \\( \\$ 76000 \\) in 2023 tor membership in a local golf chub (which was not deductible for tax purposes). In 2023 Sunland Ltd, began offering a 1-year warranty on all merchandise sold, Warranty expenses for 2023 were \\( \\$ 43,000 \\), of which \\( \\$ 29,000 \\) was actual repairs for 2023 and the remaining \\( \\$ 14,000 \\) was estimated repairs to be completed in 2024. Meal and entertainment expenses totalled \\( \\$ 23,000 \\) in 2023 , only half of which were deductible for income tax purposes. Depreciation expense for 2023 was \\( \\$ 210,000 \\). Capitai Cost Allowance (CCA) claimed for the year was \\( \\$ 234,000 \\) Sunland was subject to a \20 income tax rate for 2023 . Suntand follows IFRS. Calculate the amount of any permanent differences for 2023. Permanent differences Attempts: 0 of 1 used Question Part Score (b) The parts of this question must be completed in order. This part will be avallable whien you complete the part above. Question Part Score (c) The parts of this question must be completed in order. This part will be available when you cormplete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts