Question: Can you solve this problem and show equations as well please and highlight your answers P5 X fx A B D E F G H

Can you solve this problem and show equations as well please and highlight your answers

Can you solve this problem and show equations as well please and highlight your answers

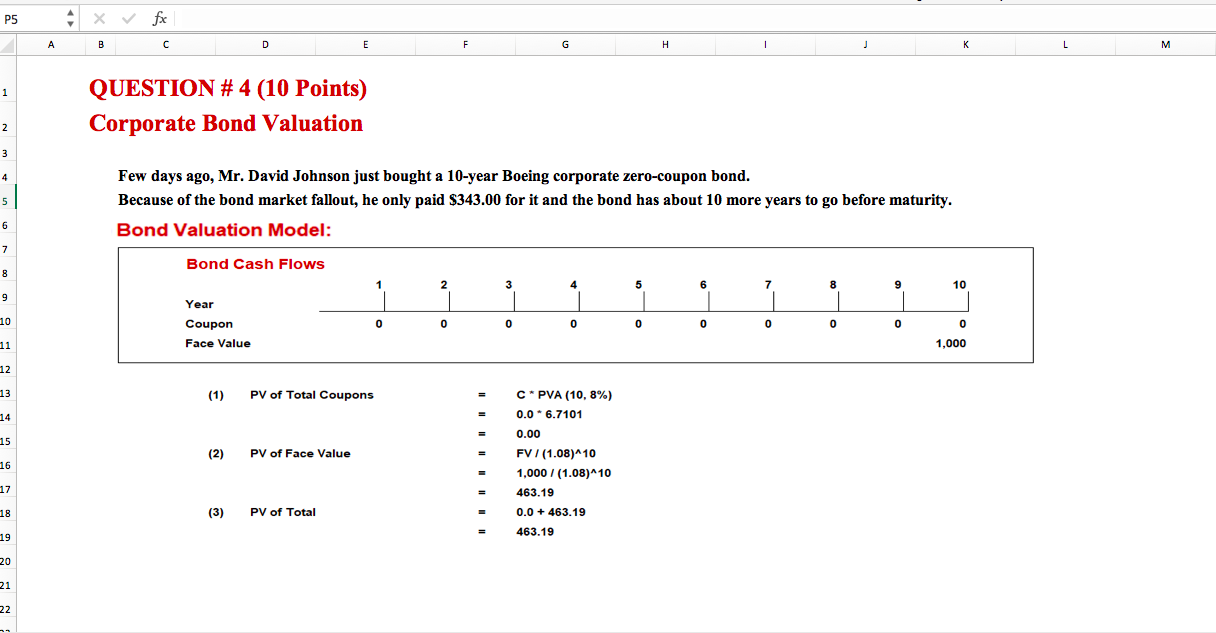

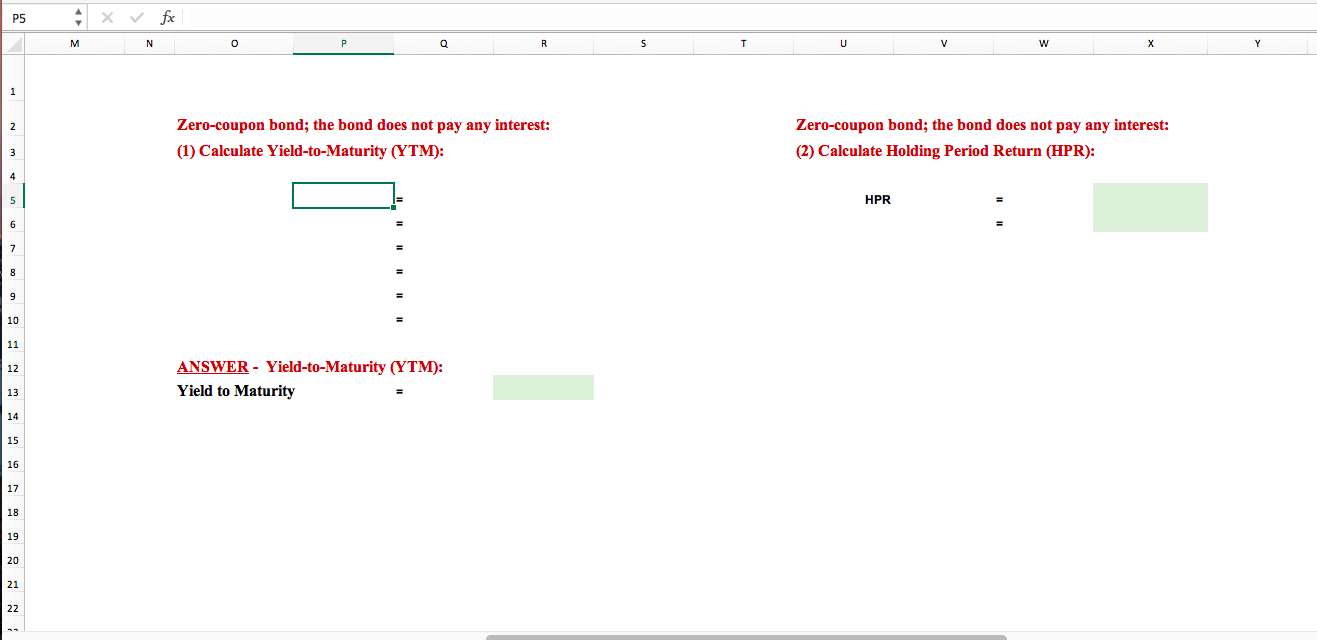

P5 X fx A B D E F G H 1 1 J K L M 1 QUESTION #4 (10 Points) Corporate Bond Valuation 2 3 4 5 Few days ago, Mr. David Johnson just bought a 10-year Boeing corporate zero-coupon bond. Because of the bond market fallout, he only paid $343.00 for it and the bond has about 10 more years to go before maturity. Bond Valuation Model: 6 7 Bond Cash Flows 8 1 2 3 4 5 6 7 8 9 10 9 10 Year Coupon Face Value 0 0 0 0 0 0 0 0 0 0 1,000 11 12 13 (1) PV of Total Coupons = 14 15 (2) PV of Face Value 16 CPVA (10,8%) 0.0 * 6.7101 0.00 FV I (1.08)^10 1,000 / (1.08) 10 463.19 0.0 + 463.19 + 463.19 17 18 (3 (3) PV of Total = 19 20 21 22 P5 x foc M N o Q S T V w Y 1 2. Zero-coupon bond; the bond does not pay any interest: (1) Calculate Yield-to-Maturity (YTM): Zero-coupon bond; the bond does not pay any interest: (2) Calculate Holding Period Return (HPR): 3 HPR 7 8 9 10 11 12 ANSWER - Yield-to-Maturity (YTM): Yield to Maturity 13 14 15 16 17 18 19 20 21 22 P5 X fx A B D E F G H 1 1 J K L M 1 QUESTION #4 (10 Points) Corporate Bond Valuation 2 3 4 5 Few days ago, Mr. David Johnson just bought a 10-year Boeing corporate zero-coupon bond. Because of the bond market fallout, he only paid $343.00 for it and the bond has about 10 more years to go before maturity. Bond Valuation Model: 6 7 Bond Cash Flows 8 1 2 3 4 5 6 7 8 9 10 9 10 Year Coupon Face Value 0 0 0 0 0 0 0 0 0 0 1,000 11 12 13 (1) PV of Total Coupons = 14 15 (2) PV of Face Value 16 CPVA (10,8%) 0.0 * 6.7101 0.00 FV I (1.08)^10 1,000 / (1.08) 10 463.19 0.0 + 463.19 + 463.19 17 18 (3 (3) PV of Total = 19 20 21 22 P5 x foc M N o Q S T V w Y 1 2. Zero-coupon bond; the bond does not pay any interest: (1) Calculate Yield-to-Maturity (YTM): Zero-coupon bond; the bond does not pay any interest: (2) Calculate Holding Period Return (HPR): 3 HPR 7 8 9 10 11 12 ANSWER - Yield-to-Maturity (YTM): Yield to Maturity 13 14 15 16 17 18 19 20 21 22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts