Question: can you solve this question for me ? Help Save & E Saved Submit Chapter 10 Lab Exercise Al-9 Payment of payroll deductions LO3 5

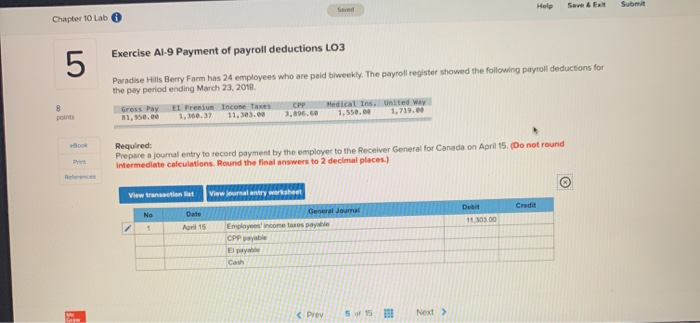

Help Save & E Saved Submit Chapter 10 Lab Exercise Al-9 Payment of payroll deductions LO3 5 Paradise Hills Berry Farm has 24 employees who are paid biweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2018 Gross Pay Premium Income Taxes CPP Medical Ins. United Way 81,950.00 1.360.37 11,383.00 1,550.00 1,719.00 8 Required: Prepare a journal entry to record payment by the employer to the Receiver General for Canada on April 15. (Do not round Intermediate calculations. Round the final answers to 2 decimal places.) References View transaction lit View journal entry worksheet Credit No Date April 15 Del 110300 General Journal Employees'income taxes payable CPP payable El paye Casti Help Save & E Saved Submit Chapter 10 Lab Exercise Al-9 Payment of payroll deductions LO3 5 Paradise Hills Berry Farm has 24 employees who are paid biweekly. The payroll register showed the following payroll deductions for the pay period ending March 23, 2018 Gross Pay Premium Income Taxes CPP Medical Ins. United Way 81,950.00 1.360.37 11,383.00 1,550.00 1,719.00 8 Required: Prepare a journal entry to record payment by the employer to the Receiver General for Canada on April 15. (Do not round Intermediate calculations. Round the final answers to 2 decimal places.) References View transaction lit View journal entry worksheet Credit No Date April 15 Del 110300 General Journal Employees'income taxes payable CPP payable El paye Casti

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts