Question: can you solve this using excel solver, only A Portfolio Optimization You are considering investing in four stocks, and have collected the following information on

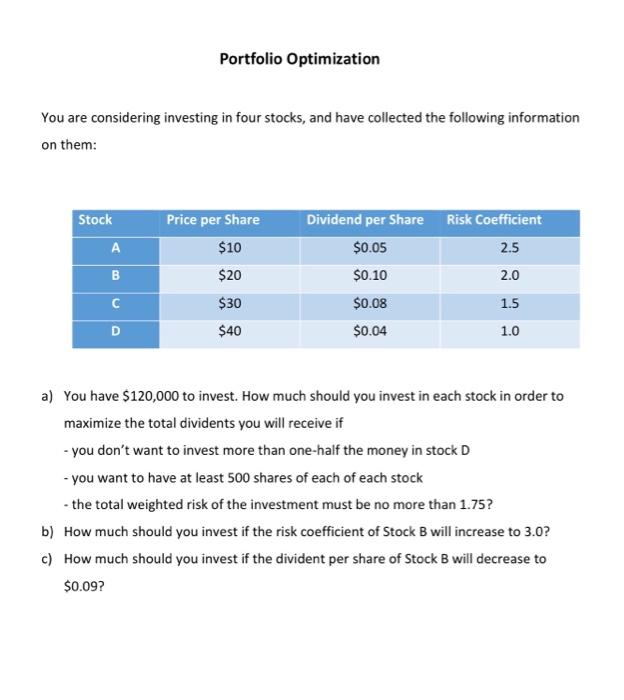

Portfolio Optimization You are considering investing in four stocks, and have collected the following information on them: Stock A Price per Share $10 B $20 Dividend per Share Risk Coefficient $0.05 2.5 $0.10 2.0 $0.08 1.5 $0.04 1.0 $30 D $40 a) You have $120,000 to invest. How much should you invest in each stock in order to maximize the total dividents you will receive if - you don't want to invest more than one-half the money in stock D - you want to have at least 500 shares of each of each stock - the total weighted risk of the investment must be no more than 1.75? b) How much should you invest if the risk coefficient of Stock B will increase to 3.0? c) How much should you invest if the divident per share of Stock B will decrease to $0.09? Portfolio Optimization You are considering investing in four stocks, and have collected the following information on them: Stock A Price per Share $10 B $20 Dividend per Share Risk Coefficient $0.05 2.5 $0.10 2.0 $0.08 1.5 $0.04 1.0 $30 D $40 a) You have $120,000 to invest. How much should you invest in each stock in order to maximize the total dividents you will receive if - you don't want to invest more than one-half the money in stock D - you want to have at least 500 shares of each of each stock - the total weighted risk of the investment must be no more than 1.75? b) How much should you invest if the risk coefficient of Stock B will increase to 3.0? c) How much should you invest if the divident per share of Stock B will decrease to $0.09

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts