Question: Can you solve using excel? I ugut le WUUIU U DUOI UIT Il ne palu A n $30,000 cash for a new car. Then he

Can you solve using excel?

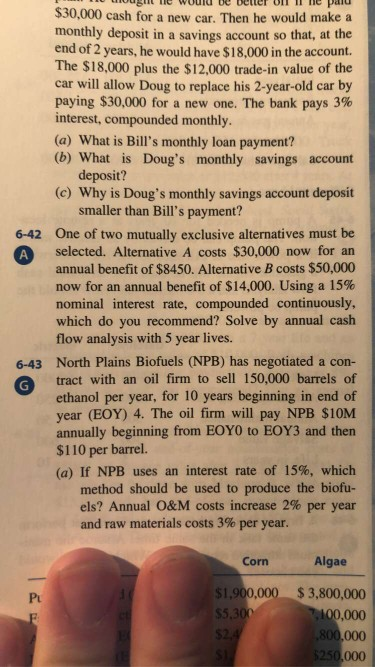

I ugut le WUUIU U DUOI UIT Il ne palu A n $30,000 cash for a new car. Then he would make a monthly deposit in a savings account so that, at the end of 2 years, he would have $18,000 in the account. The $18,000 plus the $12,000 trade-in value of the car will allow Doug to replace his 2-year-old car by paying $30,000 for a new one. The bank pays 3% interest, compounded monthly. (a) What is Bill's monthly loan payment? (b) What is Doug's monthly savings account deposit? (c) Why is Doug's monthly savings account deposit smaller than Bill's payment? 6-42 One of two mutually exclusive alternatives must be selected. Alternative A costs $30,000 now for an annual benefit of $8450. Alternative B costs $50,000 now for an annual benefit of $14,000. Using a 15% nominal interest rate, compounded continuously, which do you recommend? Solve by annual cash flow analysis with 5 year lives. 6-43 North Plains Biofuels (NPB) has negotiated a con- tract with an oil firm to sell 150,000 barrels of ethanol per year, for 10 years beginning in end of year (EOY) 4. The oil firm will pay NPB $10M annually beginning from EOYO to EOY3 and then $110 per barrel. (a) If NPB uses an interest rate of 15%, which method should be used to produce the biofu- els? Annual O&M costs increase 2% per year and raw materials costs 3% per year. Corn Algae $1,900,000 $5,300 $3,800,000 2,100,000 ,800,000 $250,000 I ugut le WUUIU U DUOI UIT Il ne palu A n $30,000 cash for a new car. Then he would make a monthly deposit in a savings account so that, at the end of 2 years, he would have $18,000 in the account. The $18,000 plus the $12,000 trade-in value of the car will allow Doug to replace his 2-year-old car by paying $30,000 for a new one. The bank pays 3% interest, compounded monthly. (a) What is Bill's monthly loan payment? (b) What is Doug's monthly savings account deposit? (c) Why is Doug's monthly savings account deposit smaller than Bill's payment? 6-42 One of two mutually exclusive alternatives must be selected. Alternative A costs $30,000 now for an annual benefit of $8450. Alternative B costs $50,000 now for an annual benefit of $14,000. Using a 15% nominal interest rate, compounded continuously, which do you recommend? Solve by annual cash flow analysis with 5 year lives. 6-43 North Plains Biofuels (NPB) has negotiated a con- tract with an oil firm to sell 150,000 barrels of ethanol per year, for 10 years beginning in end of year (EOY) 4. The oil firm will pay NPB $10M annually beginning from EOYO to EOY3 and then $110 per barrel. (a) If NPB uses an interest rate of 15%, which method should be used to produce the biofu- els? Annual O&M costs increase 2% per year and raw materials costs 3% per year. Corn Algae $1,900,000 $5,300 $3,800,000 2,100,000 ,800,000 $250,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts