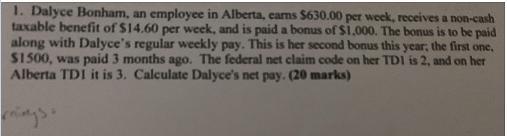

Question: 1. Dalyce Bonham, an employee in Alberta, cams $630.00 per week, receives a non-cash taxable benefit of $14.60 per week, and is paid a

1. Dalyce Bonham, an employee in Alberta, cams $630.00 per week, receives a non-cash taxable benefit of $14.60 per week, and is paid a bonus of $1.000. The bonus is to be paid along with Dalyce's regular weekly pay. This is her second bonus this year, the first one, S1500, was paid 3 months ago. The federal net claim code on her TDI is 2, and on her Alberta TDI it is 3. Calculate Dalyce's net pay. (20 marks)

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

To calculate Dalyces net pay we need to follow several steps taking into account her earnings deduct... View full answer

Get step-by-step solutions from verified subject matter experts