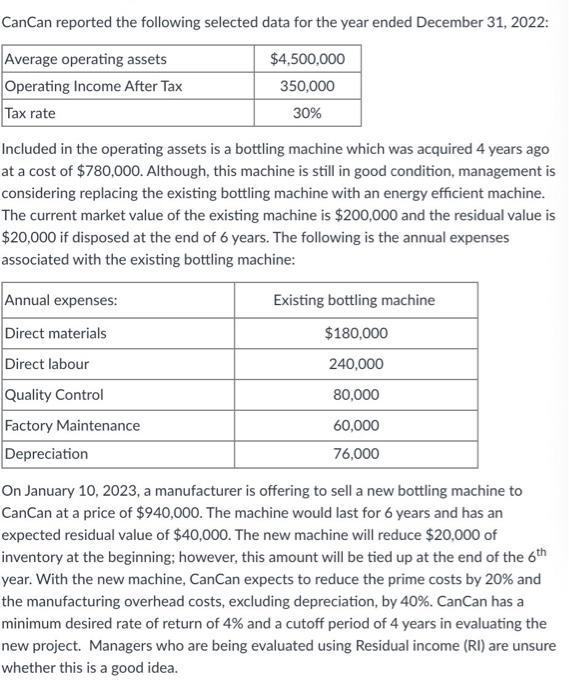

Question: CanCan reported the following selected data for the year ended December 31, 2022: $4,500,000 Average operating assets Operating Income After Tax 350,000 Tax rate

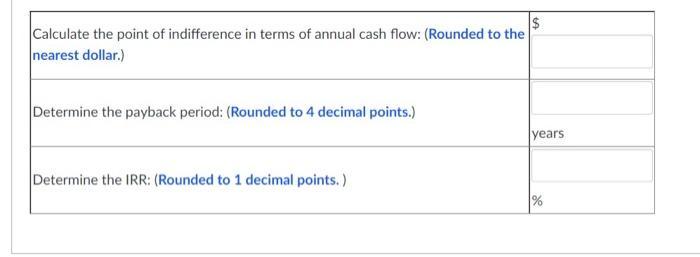

CanCan reported the following selected data for the year ended December 31, 2022: $4,500,000 Average operating assets Operating Income After Tax 350,000 Tax rate 30% Included in the operating assets is a bottling machine which was acquired 4 years ago at a cost of $780,000. Although, this machine is still in good condition, management is considering replacing the existing bottling machine with an energy efficient machine. The current market value of the existing machine is $200,000 and the residual value is $20,000 if disposed at the end of 6 years. The following is the annual expenses associated with the existing bottling machine: Annual expenses: Direct materials Direct labour Quality Control Factory Maintenance Depreciation Existing bottling machine $180,000 240,000 80,000 60,000 76,000 On January 10, 2023, a manufacturer is offering to sell a new bottling machine to CanCan at a price of $940,000. The machine would last for 6 years and has an expected residual value of $40,000. The new machine will reduce $20,000 of inventory at the beginning; however, this amount will be tied up at the end of the 6th year. With the new machine, CanCan expects to reduce the prime costs by 20% and the manufacturing overhead costs, excluding depreciation, by 40%. CanCan has a minimum desired rate of return of 4% and a cutoff period of 4 years in evaluating the new project. Managers who are being evaluated using Residual income (RI) are unsure whether this is a good idea. $ Calculate the point of indifference in terms of annual cash flow: (Rounded to the nearest dollar.) Determine the payback period: (Rounded to 4 decimal points.) Determine the IRR: (Rounded to 1 decimal points. ) years %

Step by Step Solution

3.45 Rating (168 Votes )

There are 3 Steps involved in it

Cal cul ate the point of indifference in terms of annual cash flow R ounded to the nearest dollar AN... View full answer

Get step-by-step solutions from verified subject matter experts