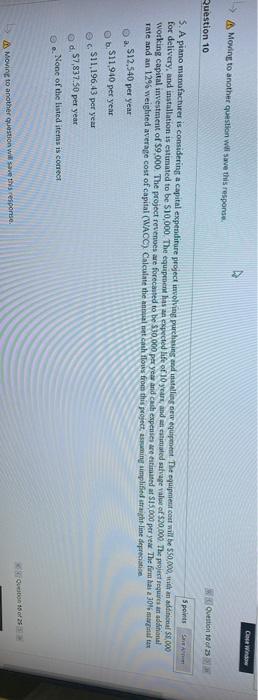

Question: Cance Moving to another question will save this response Question of Question 10 Spolus 5. A piano manufacturer is considering a capital expenditure project involving

Cance Moving to another question will save this response Question of Question 10 Spolus 5. A piano manufacturer is considering a capital expenditure project involving purchasing and installing ew equipment. The equipment out will be 550,000, with an additional 8,000 for delivery, and installation is estimated to be $10,000 The equipment has an expected life of 10 years and metasted salvage value of $20,000. The project requires an additional working capital investment of $9.000. The project revenues are forecated to be 530 000 per year and cash expenses are estimated at $15.000 per year The firm has a 30 april to Tate and an 129 weighted average cost of capital (WACC) Calculate the annual teach flows from this project, suaming amplified right line depreciate $12,540 per year S11940 per year Ob $11.196.43 per year Od $7,837.50 per year None of the listed items is correct Moving to another question will save response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts