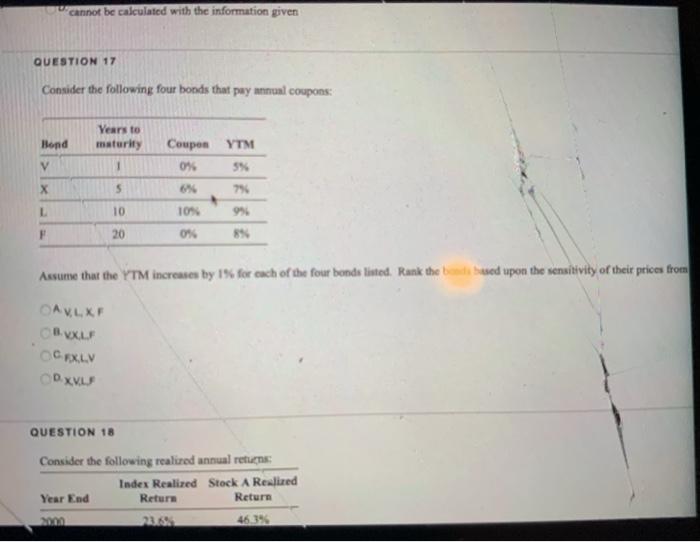

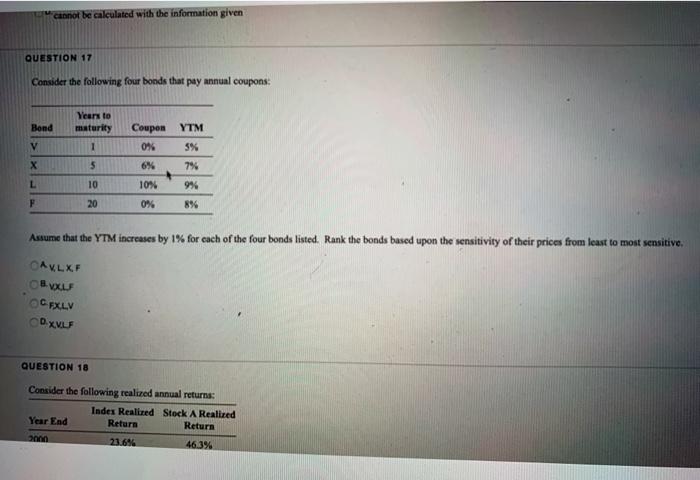

Question: cannot be calculated with the information given QUESTION 17 Consider the following four bonds that pay annual coupons: Bond V Years to maturity 1 Coupes

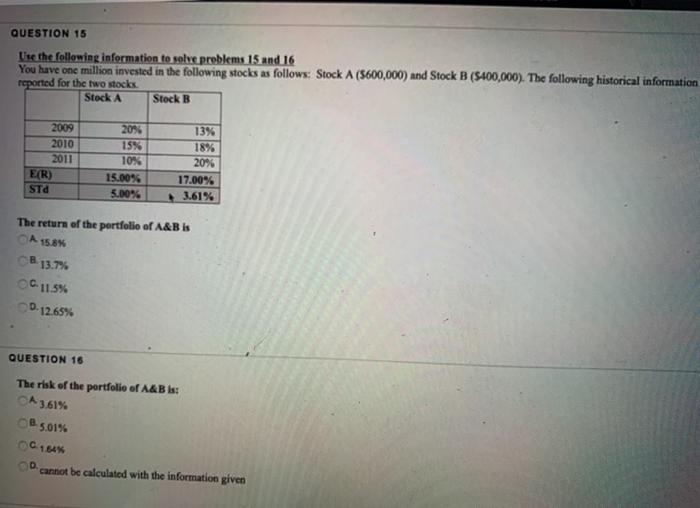

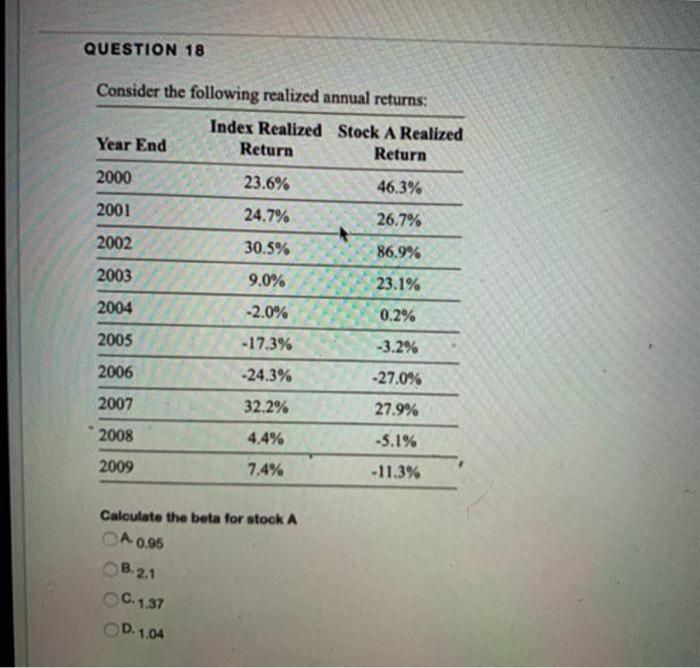

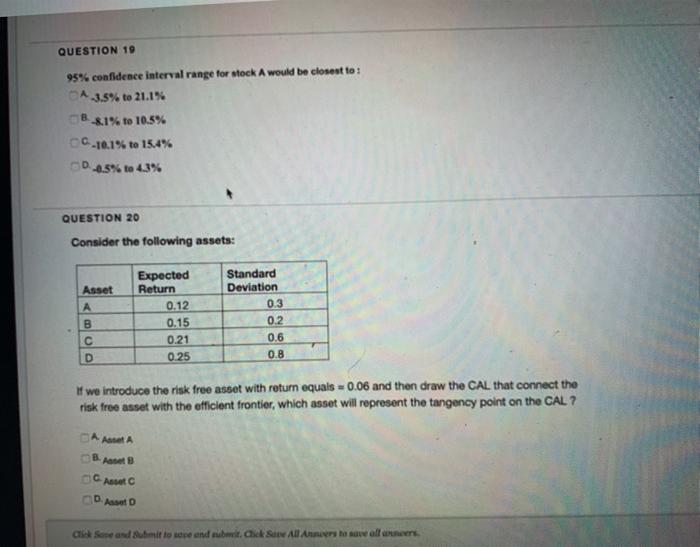

cannot be calculated with the information given QUESTION 17 Consider the following four bonds that pay annual coupons: Bond V Years to maturity 1 Coupes YTM 0% X 5 79 10 ION 99 20 0% Assume that the YTM increases by 1 for each of the four bonds listed. Rank the based upon the sensitivity of their prices from OAULXF Bu OC EXLV OD. XKS QUESTION 18 Consider the following realized annual retus: Index Realized Stock A Realized Year End Return Return 46.394 M. cannot be caleulated with the information given QUESTION 17 Consider the following four bonds that pay annual coupons: Years to maturity Bond Coupon YTM 0% 5% V 1 5 6% 7% L 10 10% 9% F 20 0% 8% Assume that the YTM increases by 1% for each of the four bonds listed. Rank the bonds based upon the sensitivity of their prices from least to most sensitive. AXLXF OBX GEXLV DXN QUESTION 18 Consider the following realized annual returns Index Realized Stock A Realized Year End Return Return 2000 23.6% 463% QUESTION 19 95% confidence interval range for stock A would be closest to : A-3.5% to 21.1% B 81% to 10.5% CG-10.1% to 15.4% -0-0.5% to 4,3% QUESTION 20 Consider the following assets: Asset B Expected Return 0.12 0.15 0.21 0.25 Standard Deviation 0.3 0.2 0.6 0.8 D If we introduce the risk free asset with return equals = 0.06 and then draw the CAL that connect the risk free asset with the efficient frontier, which asset will represent the tangency point on the CAL ? AAA B. AB DAD Chi Sead mi to sve and submit Chek Sue All Awollen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts