Question: please show work Your answers are saved automatically. Less than half of the time rema Remaining Time: 36 minutes, 16 seconds. Question Completion Status Close

please show work

please show work

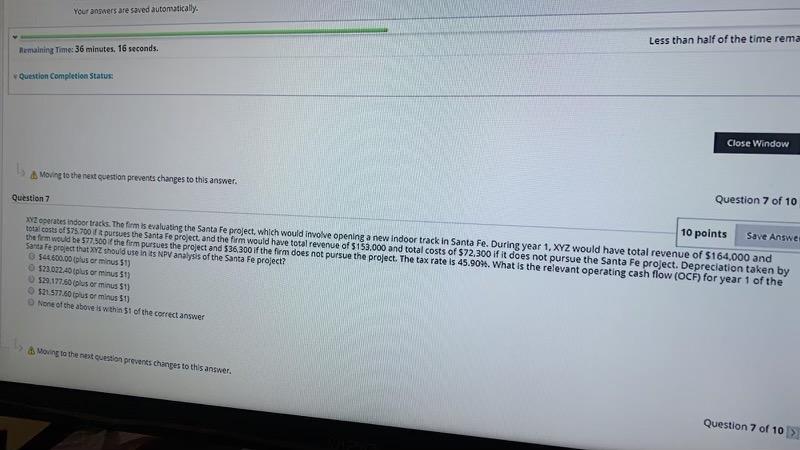

Your answers are saved automatically. Less than half of the time rema Remaining Time: 36 minutes, 16 seconds. Question Completion Status Close Window Question 7 of 10 Moving to the next question prevents changes to this answer. 10 points Save Answe Question 7 W operates indoor tracks. The firm is evaluating the Santa Fe project, which would involve opening a new indoor track in Santa Fe. During year 1, XYZ would have total revenue of $164,000 and total costs of 375.700 Ft Pursues the Santa Fe project and the form would have total revenue of 5153,000 and total costs of $72,300 if it does not pursue the Santa Fe project. Depreciation taken by the form would be 577 500 the fempursues the project and 536,300 If the firm does not pursue the project. The tax rate is 45.90%. What is the relevant operating cash flow (OCF) for year 1 of the Santaft project that XYZ should use in its NPV analysis of the Santa Fe project? 544.600.00 (plus or mus 51) $23.022.0 plus or minus 51) 529177.50 plus or min 51) $127.50 plus or minus 51) None of the above is within 51 of the correct answer Moving to the next question prevents changes to this antiver. Question 7 of 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts