Question: can't figure out d and e Buggins Incorporated is financed equally by debt and equity, each with a market value of $1.1 million. The cost

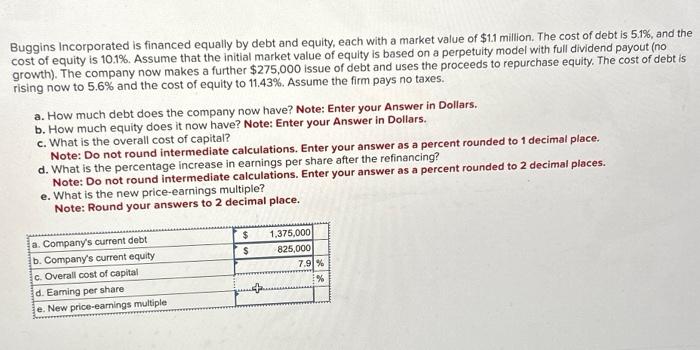

Buggins Incorporated is financed equally by debt and equity, each with a market value of $1.1 million. The cost of debt is 5.1%, and the cost of equity is 10.1%. Assume that the initial market value of equity is based on a perpetuity model with full dividend payout (no growth). The company now makes a further $275,000 issue of debt and uses the proceeds to repurchase equity. The cost of debt is rising now to 5.6% and the cost of equity to 11.43%. Assume the firm pays no taxes. a. How much debt does the company now have? Note: Enter your Answer in Dollars. b. How much equity does it now have? Note: Enter your Answer in Dollars. c. What is the overall cost of capital? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 1 decimal place. d. What is the percentage increase in earnings per share after the refinancing? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. e. What is the new price-earnings multiple? Note: Round your answers to 2 decimal place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts