Question: Capital Budgeting Decision for Project GRIZ This project involves a new type of widget. We think we can sell 6,000 units of the widget per

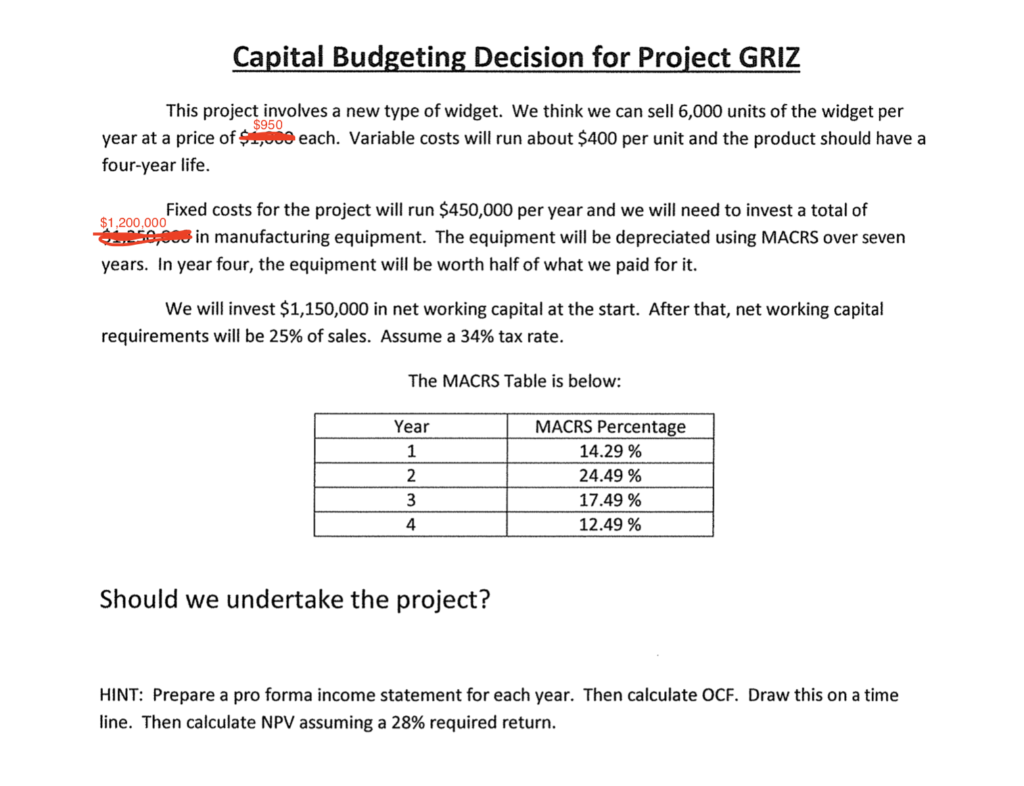

Capital Budgeting Decision for Project GRIZ This project involves a new type of widget. We think we can sell 6,000 units of the widget per $950 year at a price of $e each. Variable costs will run about $400 per unit and the product should havea four-year life. $1.20000Fixed costs for the project will run $450,000 per year and we will need to invest a total of ! esa00g in manufacturing equipment. The equipment will be depreciated using MACRS over seven years. In year four, the equipment will be worth half of what we paid for it. We will invest $1,150,000 in net working capital at the start. After that, net working capital requirements will be 25% of sales. Assume a 34% tax rate. The MACRS Table is below: Year MACRS Percentage 14.29 % 24.49 % 17.49 % 12.49 % 4 Should we undertake the project? HINT: Prepare a pro forma income statement for each year. Then calculate OCF. Draw this on a time line. Then calculate NPV assuming a 28% required return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts