Question: Find study resources VIEW THE STEP-BY-STEP SOLUTION TO Capital Budgeting Decision for Project GRIZ This projectggarohres a ... If someone could help , that'd be

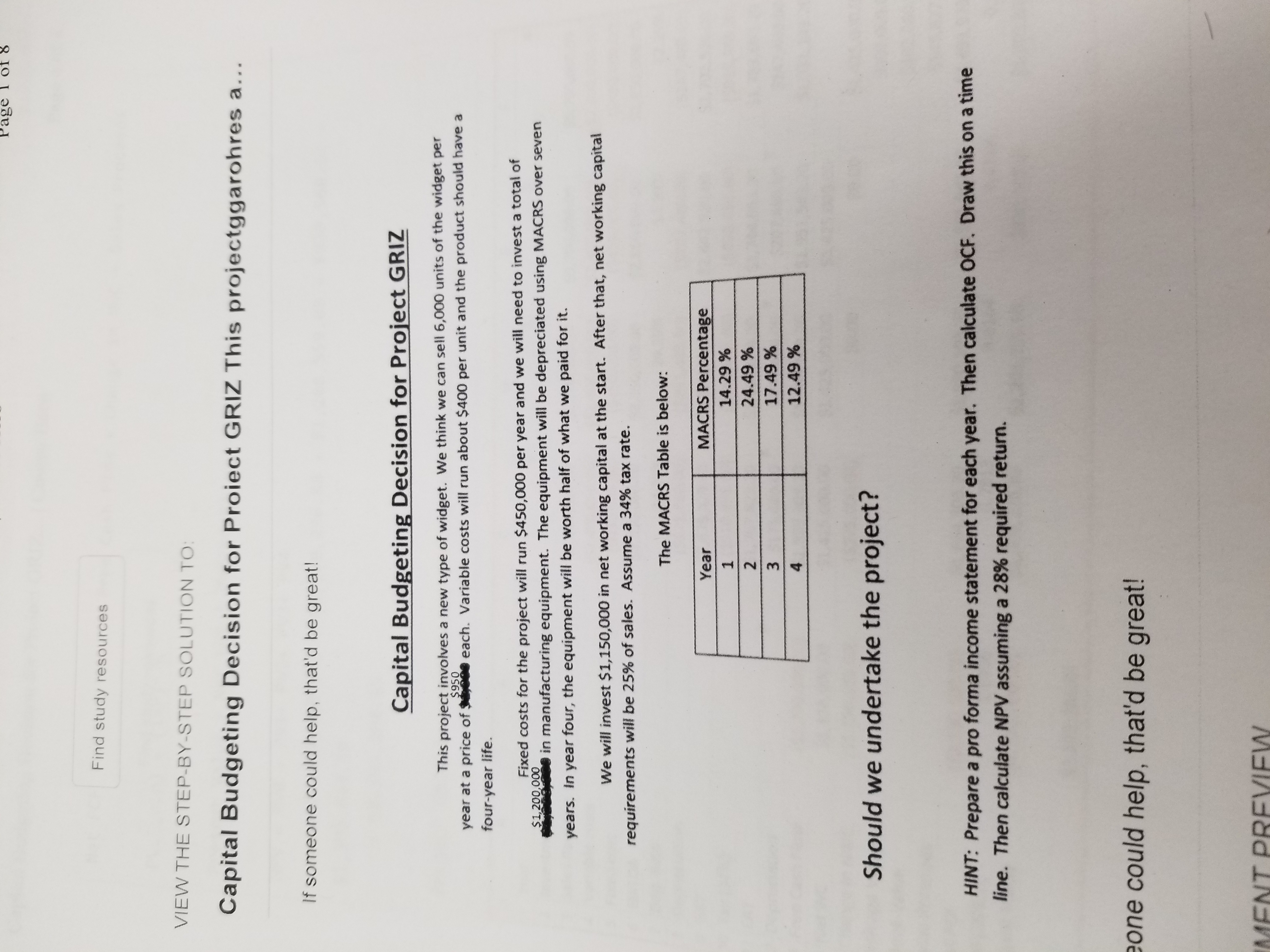

Find study resources VIEW THE STEP-BY-STEP SOLUTION TO Capital Budgeting Decision for Project GRIZ This projectggarohres a ... If someone could help , that'd be great ! Capital Budgeting Decision for Project GRIZ This project involves a new type of widget . We think we can sell 6, 000 units of the widget per* year at a price of $hong ~Beach . Variable costs will run about $400 per unit and the product should have a four - year life . $1 , 200, 000 Fixed costs for the project will run $450, 000 per year and we will need to invest a total of in manufacturing equipment . The equipment will be depreciated using MACKS over seven years . in year four , the equipment will be worth half of what we paid for it . We will invest $1 , 150, 000 in net working capital at the start . After that , net working capital requirements will be 25% of sales . Assume a 34% tax rate . The MACRS Table is below : Year MACRS Percentage 14. 29 % 24.49 % 17.49 % 12.49 % Should we undertake the project ? HINT : Prepare a pro forma income statement for each year . Then calculate OCF . Draw this on a time line . Then calculate NPV assuming a 28% required return . zone could help , that'd be great ! DREVIEWN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts