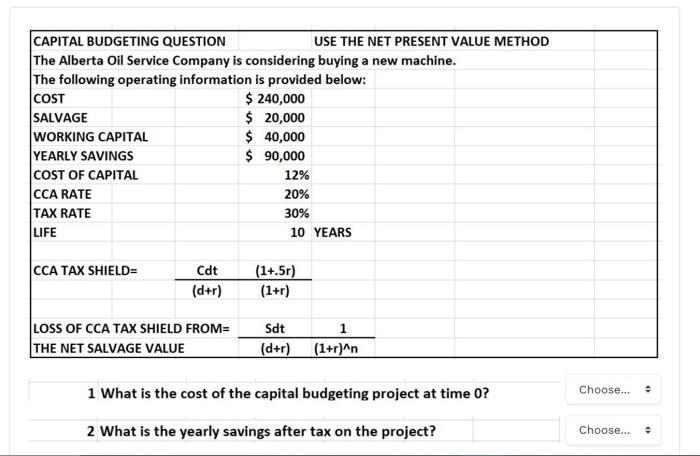

Question: CAPITAL BUDGETING QUESTION USE THE NET PRESENT VALUE METHOD The Alberta Oil Service Company is considering buying a new machine. The following operating information is

CAPITAL BUDGETING QUESTION USE THE NET PRESENT VALUE METHOD The Alberta Oil Service Company is considering buying a new machine. The following operating information is provided below: \begin{tabular}{|l|c|} \hline COST & $240,000 \\ \hline SALVAGE & $20,000 \\ \hline WORKING CAPITAL & $40,000 \\ YEARLY SAVINGS & $90,000 \\ \hline COST OF CAPITAL & 12% \\ \hline CCA RATE & 20% \\ \hline TAX RATE & 30% \\ \hline LIFE & 10 YEARS \\ \hline \end{tabular} CCA TAX SHIELD = \begin{tabular}{cc} Cdt & (1+.5r) \\ \hline(d+r) & (1+r) \end{tabular} \begin{tabular}{lcc} LOSS OF CCA TAX SHIELD FROM = & Sdt & 1 \\ \cline { 2 - 3 } THE NET SALVAGE VALUE \end{tabular} 1 What is the cost of the capital budgeting project at time 0 ? Choose... 2 What is the yearly savings after tax on the project? Choose... = 3 What is the present value of the savings for the project? Choose... 4 What is the present value of the salvage value of the machine? Choose... * 5 What is the CCA tax shield from the machine? Choose... 6 What is the cost of the lost tax shield from the salvage? Choose... 7 What is the present value of the working capital inflow? Choose... 8 INDEPENDENT QUESTION: Assume the NPV IS NEGATIVE. What is the decision on the project based on the NPV of the project? [ACCEPT OR REJECT]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts