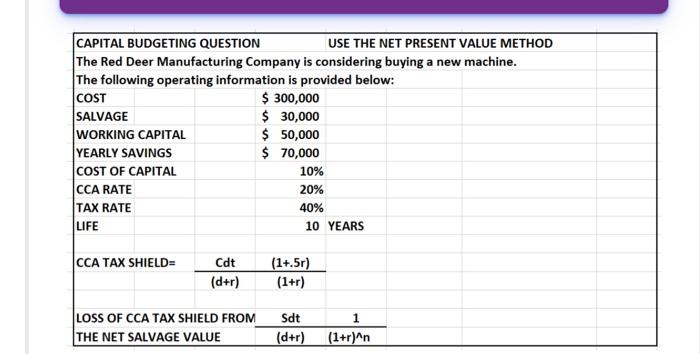

Question: CAPITAL BUDGETING QUESTION USE THE NET PRESENT VALUE METHOD The Red Deer Manufacturing Company is considering buying a new machine. The following operating information is

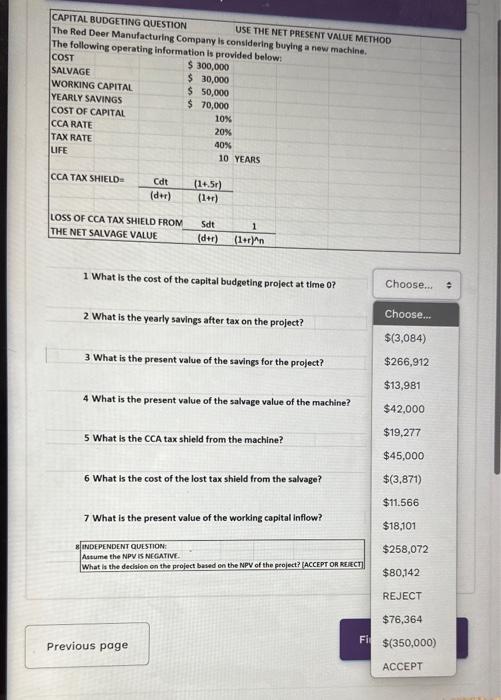

CAPITAL BUDGETING QUESTION USE THE NET PRESENT VALUE METHOD The Red Deer Manufacturing Company is considering buying a new machine. The following operating information is provided below: CAPITAL BUDGETING QUESTION The Red Deer Manufacturing Company is considering buying a new machine. The following operatine informani. . 1. What is the cost of the capital budgeting project at time 0? 2 What is the yearly savings after tax on the project? 3 What is the present value of the savings for the project? 4 What is the present value of the salvage value of the machine? 5 What is the CCA tax shield from the machine? 6 What is the cost of the lost tax shield from the salvage? 7 What is the present value of the working capital inflow? CAPITAL BUDGETING QUESTION USE THE NET PRESENT VALUE METHOD The Red Deer Manufacturing Company is considering buying a new machine. The following operating information is provided below: CAPITAL BUDGETING QUESTION The Red Deer Manufacturing Company is considering buying a new machine. The following operatine informani. . 1. What is the cost of the capital budgeting project at time 0? 2 What is the yearly savings after tax on the project? 3 What is the present value of the savings for the project? 4 What is the present value of the salvage value of the machine? 5 What is the CCA tax shield from the machine? 6 What is the cost of the lost tax shield from the salvage? 7 What is the present value of the working capital inflow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts