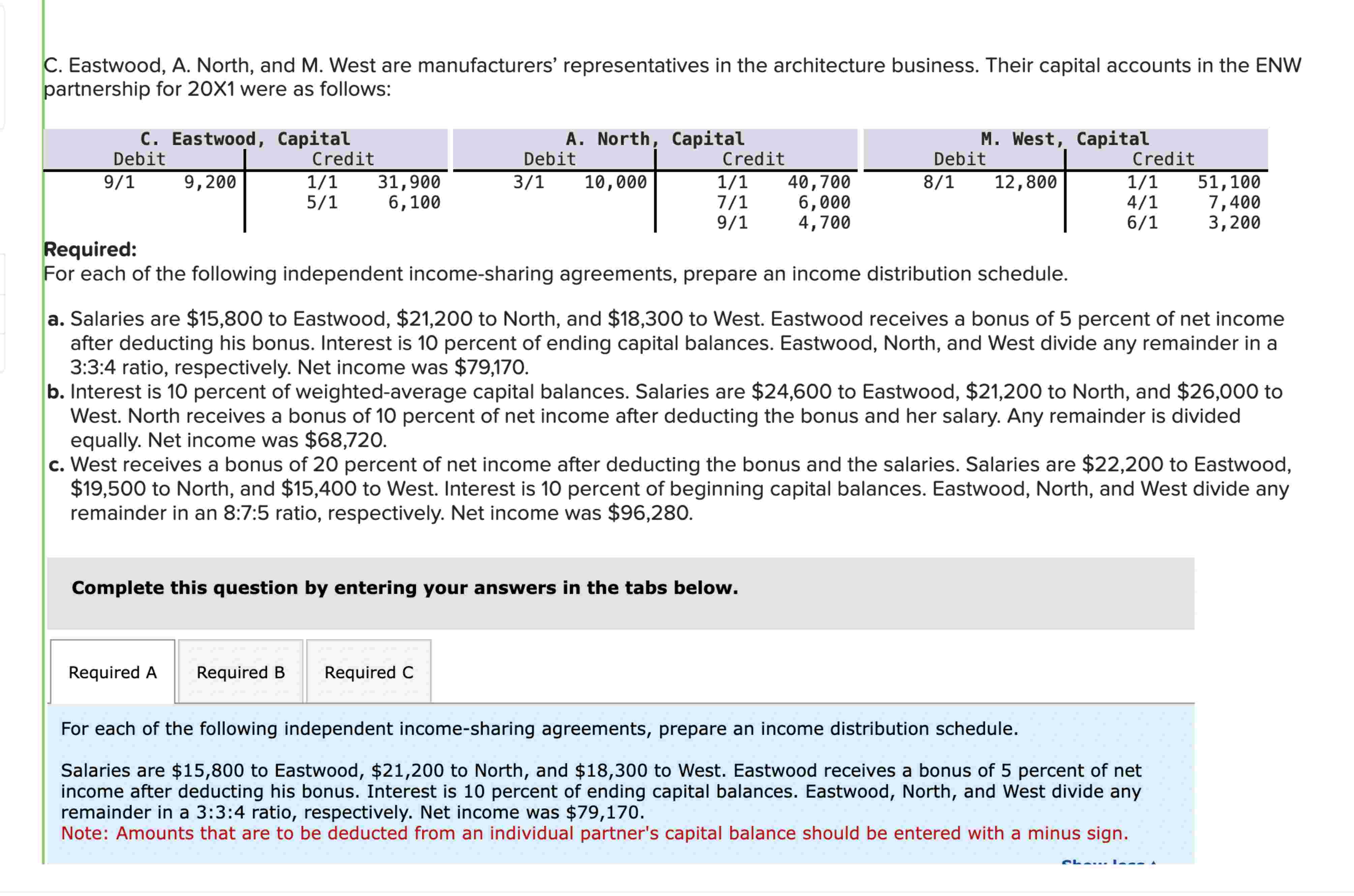

Question: CapitalDebitCredit 9 / 1 9 , 2 0 0 1 / 1 3 1 , 9 0 0 5 / 1 6 , 1 0

CapitalDebitCredit A North, CapitalDebitCredit M West, CapitalDebitCredit Required: For each of the following independent incomesharing agreements, prepare an income distribution schedule. Salaries are $ to Eastwood, $ to North, and $ to West. Eastwood receives a bonus of percent of net income after deducting his bonus. Interest is percent of ending capital balances. Eastwood, North, and West divide any remainder in a :: ratio, respectively. Net income was $ Interest is percent of weightedaverage capital balances. Salaries are $ to Eastwood, $ to North, and $ to West. North receives a bonus of percent of net income after deducting the bonus and her salary. Any remainder is divided equally. Net income was $ West receives a bonus of percent of net income after deducting the bonus and the salaries. Salaries are $ to Eastwood, $ to North, and $ to West. Interest is percent of beginning capital balances. Eastwood, North, and West divide any remainder in an :: ratio, respectively. Net income was $

C Eastwood, A North, and M West are manufacturers' representatives in the architecture business. Their capital accounts in the ENW

partnership for X were as follows:

Required:

For each of the following independent incomesharing agreements, prepare an income distribution schedule.

a Salaries are $ to Eastwood, $ to North, and $ to West. Eastwood receives a bonus of percent of net income

after deducting his bonus. Interest is percent of ending capital balances. Eastwood, North, and West divide any remainder in a

:: ratio, respectively. Net income was $

b Interest is percent of weightedaverage capital balances. Salaries are $ to Eastwood, $ to North, and $ to

West. North receives a bonus of percent of net income after deducting the bonus and her salary. Any remainder is divided

equally. Net income was $

c West receives a bonus of percent of net income after deducting the bonus and the salaries. Salaries are $ to Eastwood,

$ to North, and $ to West. Interest is percent of beginning capital balances. Eastwood, North, and West divide any

remainder in an :: ratio, respectively. Net income was $

Complete this question by entering your answers in the tabs below.

For each of the following independent incomesharing agreements, prepare an income distribution schedule.

Salaries are $ to Eastwood, $ to North, and $ to West. Eastwood receives a bonus of percent of net

income after deducting his bonus. Interest is percent of ending capital balances. Eastwood, North, and West

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock