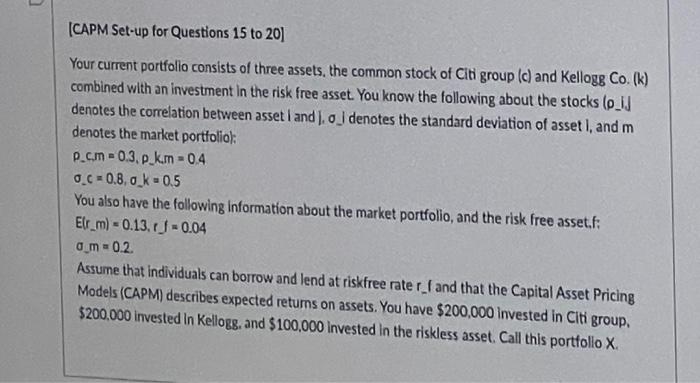

Question: (CAPM Set-up for Questions 15 to 20) Your current portfolio consists of three assets, the common stock of Citi group (c) and Kellogg Co. (K)

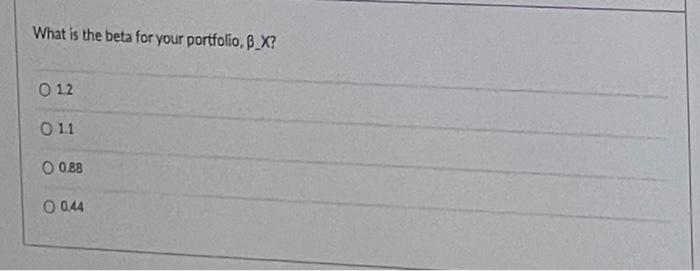

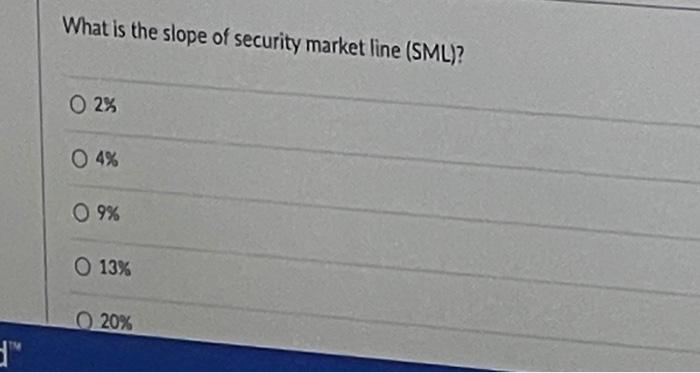

(CAPM Set-up for Questions 15 to 20) Your current portfolio consists of three assets, the common stock of Citi group (c) and Kellogg Co. (K) combined with an investment in the risk free asset. You know the following about the stocks l_IJ denotes the correlation between asset i and ), oj denotes the standard deviation of asset I, and m denotes the market portfolio): p_cm=0.3.p.k.m = 0.4 0.6 0.8.0_k - 0.5 You also have the following information about the market portfolio, and the risk free asset.fi Elr_ml = 0.13.cf = 0.04 a_m-02 Assume that individuals can borrow and lend at riskfree rater and that the Capital Asset Pricing Models (CAPM) describes expected retums on assets. You have $200,000 invested in Citigroup. $200,000 invested in Kellogs, and $100,000 invested in the riskless asset. Call this portfolio X What is the beta for your portfolio, B_X? 0 12 011 O 0.88 O 0.44 What is the slope of security market line (SML)? O 2% 04% 09% O 13% O 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts