Question: CAPSIMCore Round 0 - Report Section 1 High Level Overview How are the markets changing? Step 9: Review the Round 0 Positioning expectations, and apply

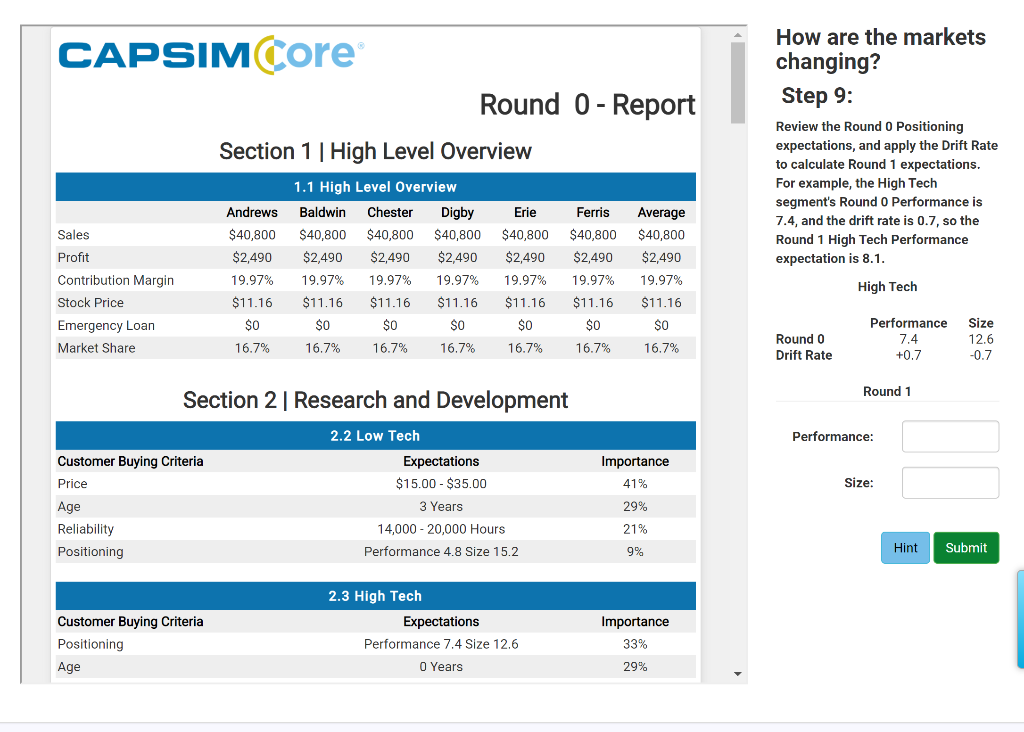

CAPSIMCore Round 0 - Report Section 1 High Level Overview How are the markets changing? Step 9: Review the Round 0 Positioning expectations, and apply the Drift Rate to calculate Round 1 expectations. For example, the High Tech segment's Round 0 Performance is 7.4, and the drift rate is 0.7, so the Round 1 High Tech Performance expectation is 8.1. High Tech Andrews $40,800 $2,490 19.97% $11.16 Ferris $40,800 $2,490 Sales Profit Contribution Margin Stock Price Emergency Loan Market Share 1.1 High Level Overview Baldwin Chester Digby $40,800 $40,800 $40,800 $2,490 $2,490 $2,490 19.97% 19.97% 19.97% $11.16 $11.16 $11.16 $0 $0 SO 16.7% 16.7% 16.7% Erie $40,800 $2,490 19.97% $11.16 $0 Average $40,800 $2,490 19.97% $11.16 19.97% $11.16 $0 $0 $0 16.7% Performance 7.4 +0.7 Size 12.6 -0.7 16.7% Round 0 Drift Rate 16.7% 16.7% Round 1 Section 2 Research and Development Performance: Importance 41% Size: Customer Buying Criteria Price Age Reliability Positioning 2.2 Low Tech Expectations $15.00 - $35.00 3 Years 14,000 - 20,000 Hours Performance 4.8 Size 15.2 29% 21% 9% Hint Submit Customer Buying Criteria Positioning Age 2.3 High Tech Expectations Performance 7.4 Size 12.6 0 Years Importance 33% 29% CAPSIMCore Round 0 - Report Section 1 High Level Overview How are the markets changing? Step 9: Review the Round 0 Positioning expectations, and apply the Drift Rate to calculate Round 1 expectations. For example, the High Tech segment's Round 0 Performance is 7.4, and the drift rate is 0.7, so the Round 1 High Tech Performance expectation is 8.1. High Tech Andrews $40,800 $2,490 19.97% $11.16 Ferris $40,800 $2,490 Sales Profit Contribution Margin Stock Price Emergency Loan Market Share 1.1 High Level Overview Baldwin Chester Digby $40,800 $40,800 $40,800 $2,490 $2,490 $2,490 19.97% 19.97% 19.97% $11.16 $11.16 $11.16 $0 $0 SO 16.7% 16.7% 16.7% Erie $40,800 $2,490 19.97% $11.16 $0 Average $40,800 $2,490 19.97% $11.16 19.97% $11.16 $0 $0 $0 16.7% Performance 7.4 +0.7 Size 12.6 -0.7 16.7% Round 0 Drift Rate 16.7% 16.7% Round 1 Section 2 Research and Development Performance: Importance 41% Size: Customer Buying Criteria Price Age Reliability Positioning 2.2 Low Tech Expectations $15.00 - $35.00 3 Years 14,000 - 20,000 Hours Performance 4.8 Size 15.2 29% 21% 9% Hint Submit Customer Buying Criteria Positioning Age 2.3 High Tech Expectations Performance 7.4 Size 12.6 0 Years Importance 33% 29%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts