Question: ( Caption: The image is a diagram titled Binomial Interest Rate Tree showing interest rates for Years 0 , 1 and Year 2 . The

Caption: The image is a diagram titled "Binomial Interest Rate Tree" showing interest rates for Years and Year The interest rates for different scenarios are provided in a treelike structure. In Year the number branches to and in Year In Year branches to and within Year branches to and within Year

On October X Ferguson analyzes the convertible bond issued by Pro Star given in Exhibit That day, the optionfree value of Pro Star's convertible bond is $ and its stock price $

EXHIBIT : Convertible Bond Issued by Pro Star, Inc.

tableAttributeValueIssue Date, December XMaturity Date, December XCoupon Rate,Samuel Samuel

Samuel & Sons is a fixedincome specialty firm that offers advisory services to Investment management companies. On October X Steele Ferguson, a senior analyst at Samuel, is reviewing three fixedrate bonds issued by a local firm, Pro Star, Inc. The three bonds, whose characteristics are given in Exhibit carry the highest credit rating.

EXHIBIT : FixedRate Bonds Issued by Pro Star, Inc.

tableBondMaturity,Coupon,Type of BondBond # October X annual,OptionfreeBond # October X annual,Callable at par on October X and on October XBond # October X annual,Putable at par on October X and on October X

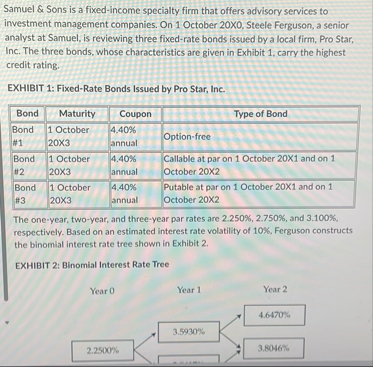

The oneyear, twoyear, and threeyear par rates are and respectively. Based on an estimated interest rate volatility of Ferguson constructs the binomial interest rate tree shown in Exhibit

EXHIBIT : Binomial Interest Rate Tree

EXHIBIT : Binomial Interest Rate Tree

Caption: The image is a diagram titled "Binomial Interest Rate Thee" showing interest rates for Years and Year The interest rates for different scenarios are provided in a treethe structure. In Year the number branches to and in Year In Year branches to and within Year branches to and within Year

On October X Ferguson analyzes the convertible bond issued by Pro Star given in Exhibit That day, the optionfree value of Pro Star's convertible bond is $ and its stock price $

Caption: The image is a diagram titled "Binomial Interest Rate Tree" showing interest rates for Years and Year The interest rates for different scenarios are provided in a treelike structure. In Year the number branches to and in Year In Year branches to and within Year branches to and within Year

On October X Ferguson analyzes the convertible bond issued by Pro Star given in Exhibit That day, the optionfree value of Pro Star's convertible bond is $ and its stock price $

EXHIBIT : Convertible Bond Issued by Pro Star, Inc.

tableAttributeValueIssue Date, December XMaturity Date, December XCoupon Rate, What is the value of Bond number two and Bond number three also all else being equal a rise and interest rates will most likely result in the value of an option embedded in bond three decreasing increasing or remaining unchanged

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock