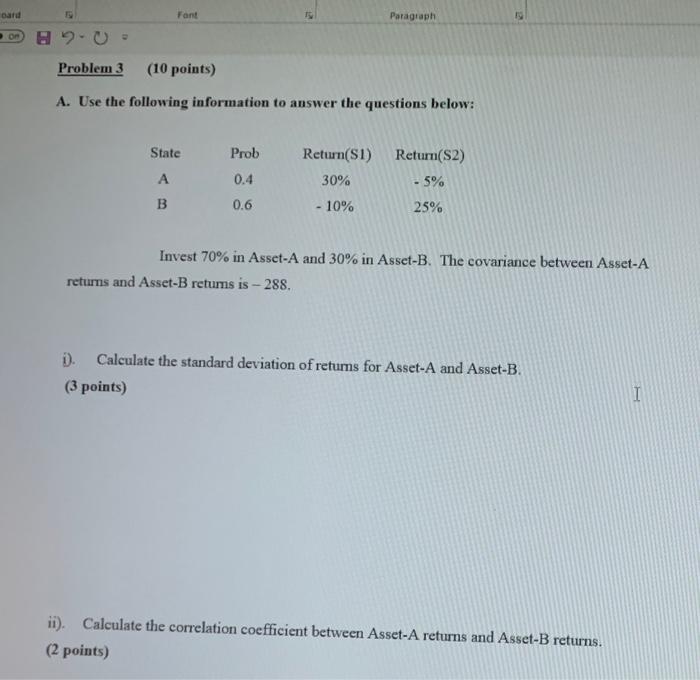

Question: card Font Paragraph on B9-0- Problem 3 (10 points) A. Use the following information to answer the questions below: State Prob Return(S2) - 5% Return(S1)

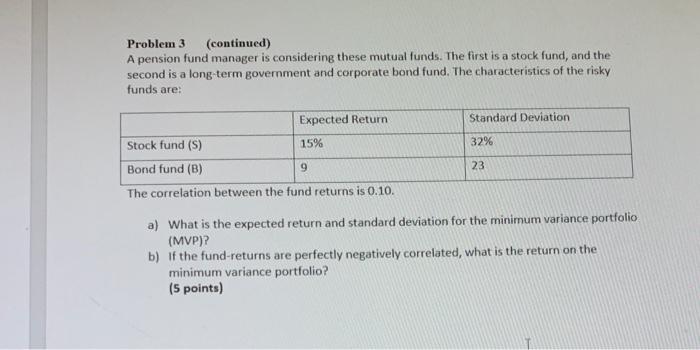

card Font Paragraph on B9-0- Problem 3 (10 points) A. Use the following information to answer the questions below: State Prob Return(S2) - 5% Return(S1) 30% - 10% 0.4 0.6 B 25% Invest 70% in Asset-A and 30% in Asset-B. The covariance between Asset-A returns and Asset-B retums is - 288. i). Calculate the standard deviation of retums for Asset-A and Asset-B. (3 points) I ii). Calculate the correlation coefficient between Asset-A returns and Asset-B returns. (2 points) Problem 3 (continued) A pension fund manager is considering these mutual funds. The first is a stock fund, and the second is a long-term government and corporate bond fund. The characteristics of the risky funds are: Standard Deviation 32% Expected Return Stock fund (S) 15% Bond fund (B) 9 The correlation between the fund returns is 0.10. 23 a) What is the expected return and standard deviation for the minimum variance portfolio (MVP)? b) If the fund-returns are perfectly negatively correlated, what is the return on the minimum variance portfolio? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts