Question: Carmen's current year individual return reports a $ 2 0 , 0 0 0 deduction for a questionable item not relating to a tax -

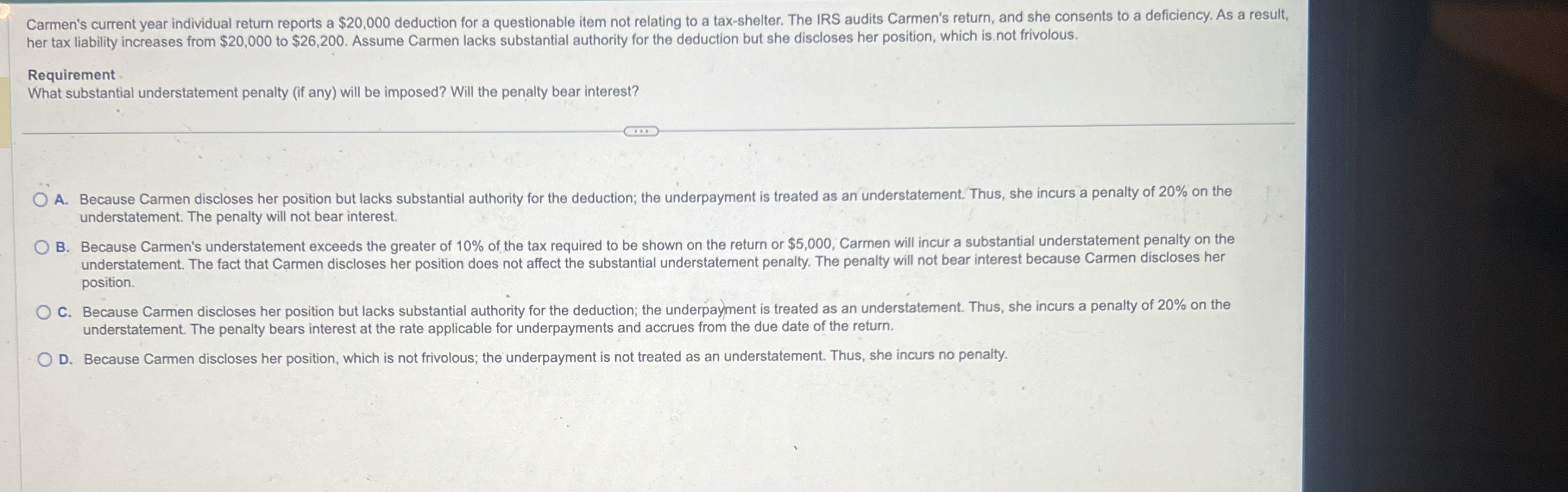

Carmen's current year individual return reports a $ deduction for a questionable item not relating to a taxshelter. The IRS audits Carmen's return, and she consents to a deficiency. As a result, her tax liability increases from $ to $ Assume Carmen lacks substantial authority for the deduction but she discloses her position, which isnot frivolous.

Requirement

What substantial understatement penalty if any will be imposed? Will the penalty bear interest?

A Because Carmen discloses her position but lacks substantial authority for the deduction; the underpayment is treated as an understatement. Thus, she incurs a penalty of on the understatement. The penalty will not bear interest.

B Because Carmen's understatement exceeds the greater of of the tax required to be shown on the return or $ Carmen will incur a substantial understatement penalty on the understatement. The fact that Carmen discloses her position does not affect the substantial understatement penalty. The penalty will not bear interest because Carmen discloses her position.

C Because Carmen discloses her position but lacks substantial authority for the deduction; the underpayment is treated as an understatement. Thus, she incurs a penalty of on the understatement. The penalty bears interest at the rate applicable for underpayments and accrues from the due date of the return.

D Because Carmen discloses her position, which is not frivolous; the underpayment is not treated as an understatement. Thus, she incurs no penalty.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock