Question: Case 1 1 - 5 5 Comprehensive Variance Analysis Used to Explain Operational Results; Review of Chapters 1 0 and 1 1 ; Activity -

Case Comprehensive Variance Analysis Used to Explain Operational Results; Review of Chapters and ; ActivityBased Costing; Sales Variances Appendix BLO

Skip to question

The following information applies to the questions displayed below.

Aunt Mollys Old Fashioned Cookies bakes cookies for retail stores. The companys bestselling cookie is chocolate nut supreme, which is marketed as a gourmet cookie and regularly sells for $ per pound. The standard cost per pound of chocolate nut supreme, based on Aunt Mollys normal monthly production of pounds, is as follows:

Cost Item Quantity Standard

Unit Cost Total Cost

Direct materials:

Cookie mix oz $ per oz $

Milk chocolate oz per oz

Almonds oz per oz

$

Direct labor:

Mixing min. per hr $

Baking min. per hr

$

Variable overhead min. per directlabor hr $

Total standard cost per pound $

Directlabor rates include employee benefits.

Applied on the basis of directlabor hours.

Aunt Mollys management accountant, Karen Blair, prepares monthly budget reports based on these standard costs. Aprils contribution report, which compares budgeted and actual performance, is shown in the following schedule.

Contribution Report for April

Static

Budget Actual Variance

Units in pounds F

Revenue $ $ $ F

Direct material $ $ $ U

Direct labor F

Variable overhead U

Total variable costs $ $ $ U

Contribution margin $ $ $ U

Justine Madison, president of the company, is disappointed with the results. Despite a sizable increase in the number of cookies sold, the products expected contribution to the overall profitability of the firm decreased. Madison has asked Blair to identify the reason why the contribution margin decreased. Blair has gathered the following information to help in her analysis of the decrease.

Usage Report for April

Cost Item Quantity Actual Cost

Direct materials:

Cookie mix oz $

Milk chocolate oz

Almonds oz

Direct labor:

Mixing min.

Baking min.

Variable overhead

Total variable costs $

Case Part

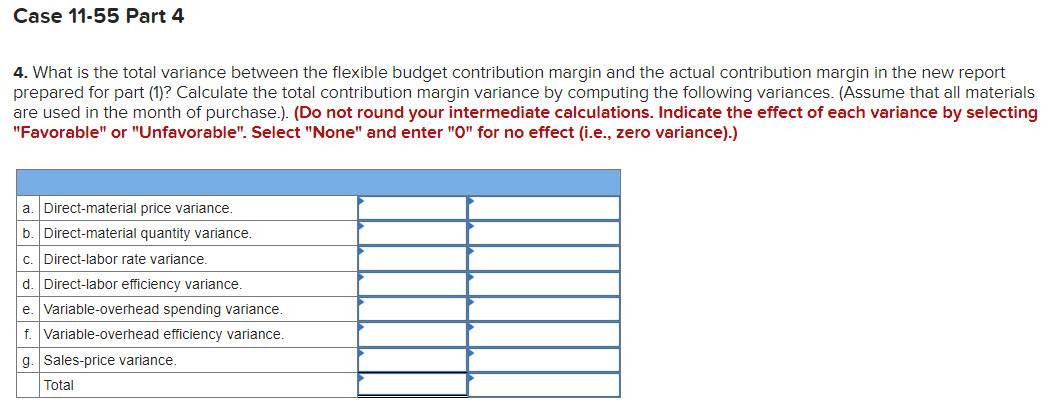

What is the total variance between the flexible budget contribution margin and the actual contribution margin in the new report prepared for part Calculate the total contribution margin variance by computing the following variances. Assume that all materials are used in the month of purchase.Do not round your intermediate calculations. Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter for no effect ie zero varianceCase Part

What is the total variance between the flexible budget contribution margin and the actual contribution margin in the new report

prepared for part Calculate the total contribution margin variance by computing the following variances. Assume that all materials

are used in the month of purchase.Do not round your intermediate calculations. Indicate the effect of each variance by selecting

"Favorable" or "Unfavorable". Select "None" and enter for no effect ie zero variance

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock