Question: Required information Case 11-55 Comprehensive Variance Analysis Used to Explain Operational Results; Review of Chapters 10 and 11; Activity-Based Costing; Sales Variances (Appendix B) (LO

![questions displayed below.] Aunt Molly's Old Fashioned Cookies bakes cookies for retail](https://s3.amazonaws.com/si.experts.images/answers/2024/08/66cd28662e926_25366cd2865c9cb6.jpg)

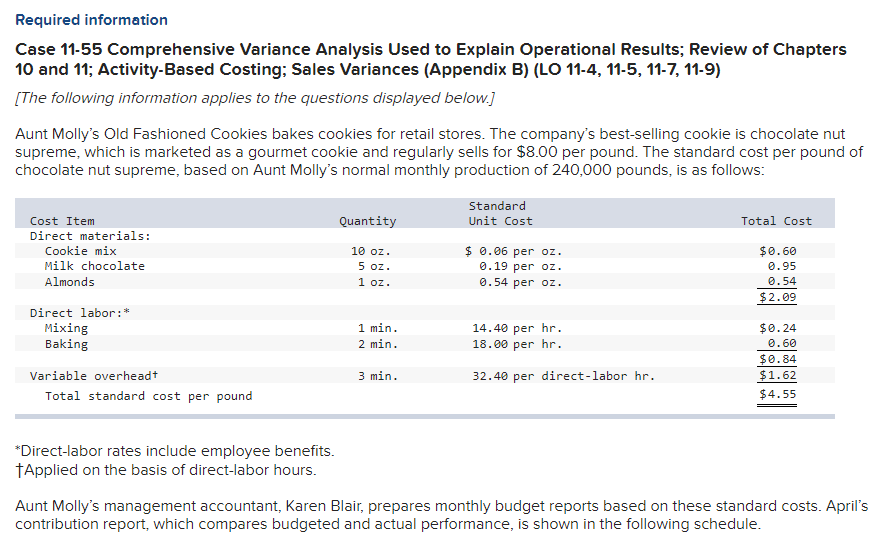

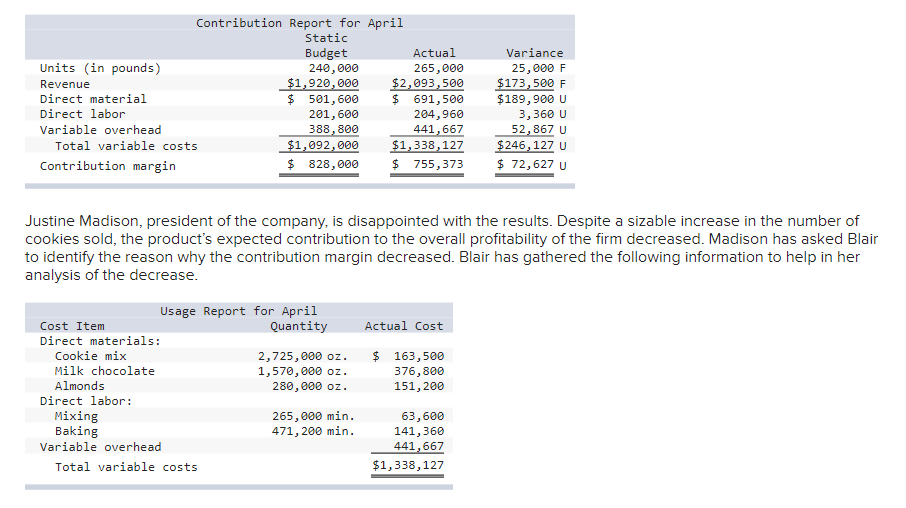

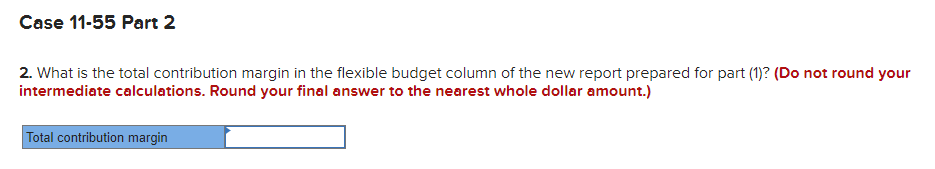

Required information Case 11-55 Comprehensive Variance Analysis Used to Explain Operational Results; Review of Chapters 10 and 11; Activity-Based Costing; Sales Variances (Appendix B) (LO 11-4, 11-5, 11-7, 11-9) [The following information applies to the questions displayed below.] Aunt Molly's Old Fashioned Cookies bakes cookies for retail stores. The company's best-selling cookie is chocolate nut supreme, which is marketed as a gourmet cookie and regularly sells for $8.00 per pound. The standard cost per pound of chocolate nut supreme, based on Aunt Molly's normal monthly production of 240,000 pounds, is as follows: *Direct-labor rates include employee benefits. Applied on the basis of direct-labor hours. Aunt Molly's management accountant, Karen Blair, prepares monthly budget reports based on these standard costs. April's contribution report, which compares budgeted and actual performance, is shown in the following schedule. Justine Madison, president of the company, is disappointed with the results. Despite a sizable increase in the number of cookies sold, the product's expected contribution to the overall profitability of the firm decreased. Madison has asked Blair to identify the reason why the contribution margin decreased. Blair has gathered the following information to help in her analysis of the decrease. 2. What is the total contribution margin in the flexible budget column of the new report prepared for part (1)? (Do not round your intermediate calculations. Round your final answer to the nearest whole dollar amount.) 4. What is the total variance between the flexible budget contribution margin and the actual contribution margin in the new report prepared for part (1)? Calculate the total contribution margin variance by computing the following variances. (Assume that all materials are used in the month of purchase.). (Do not round your intermediate calculations. Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect (i.e., zero variance).)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts