Question: Case 1: 1-Winston Tremblay, engineer and expert programmer, is very concerned about his next personal income tax return for the 2023 tax year. He

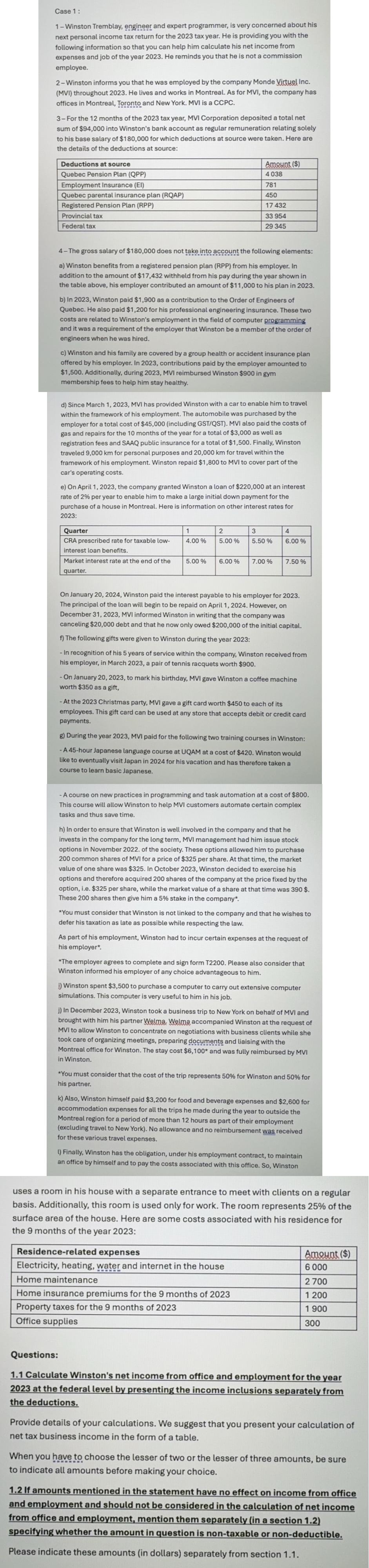

Case 1: 1-Winston Tremblay, engineer and expert programmer, is very concerned about his next personal income tax return for the 2023 tax year. He is providing you with the following information so that you can help him calculate his net income from expenses and job of the year 2023. He reminds you that he is not a commission employee. 2-Winston informs you that he was employed by the company Monde Virtuel Inc. (MVI) throughout 2023. He lives and works in Montreal. As for MVI, the company has offices in Montreal, Toronto and New York. MVI is a CCPC. 3- For the 12 months of the 2023 tax year, MVI Corporation deposited a total net sum of $94,000 into Winston's bank account as regular remuneration relating solely to his base salary of $180,000 for which deductions at source were taken. Here are the details of the deductions at source: Deductions at source Quebec Pension Plan (QPP) Employment Insurance (El) Quebec parental insurance plan (RQAP) Registered Pension Plan (RPP) Provincial tax Federal tax Amount ($) 4038 781 450 17432 33 954 29 345 4-The gross salary of $180,000 does not take into account the following elements: a) Winston benefits from a registered pension plan (RPP) from his employer. In addition to the amount of $17,432 withheld from his pay during the year shown in the table above, his employer contributed an amount of $11,000 to his plan in 2023. b) In 2023, Winston paid $1,900 as a contribution to the Order of Engineers of Quebec. He also paid $1,200 for his professional engineering insurance. These two costs are related to Winston's employment in the field of computer programming and it was a requirement of the employer that Winston be a member of the order of engineers when he was hired. c) Winston and his family are covered by a group health or accident insurance plan offered by his employer. In 2023, contributions paid by the employer amounted to $1,500. Additionally, during 2023, MVI reimbursed Winston $900 in gym membership fees to help him stay healthy. d) Since March 1, 2023, MVI has provided Winston with a car to enable him to travel within the framework of his employment. The automobile was purchased by the employer for a total cost of $45,000 (including GST/QST). MVI also paid the costs of gas and repairs for the 10 months of the year for a total of $3,000 as well as registration fees and SAAQ public insurance for a total of $1,500. Finally, Winston traveled 9,000 km for personal purposes and 20,000 km for travel within the framework of his employment. Winston repaid $1,800 to MVI to cover part of the car's operating costs. e) On April 1, 2023, the company granted Winston a loan of $220,000 at an interest rate of 2% per year to enable him to make a large initial down payment for the purchase of a house in Montreal. Here is information on other interest rates for 2023: Quarter 1 2 3 4 CRA prescribed rate for taxable low- interest loan benefits. 4.00 % 5.00% 5.50% 6.00 % Market interest rate at the end of the quarter. 5.00% 6.00% 7.00 % 7.50% On January 20, 2024, Winston paid the interest payable to his employer for 2023. The principal of the loan will begin to be repaid on April 1, 2024. However, on December 31, 2023, MVI informed Winston in writing that the company was canceling $20,000 debt and that he now only owed $200,000 of the initial capital. f) The following gifts were given to Winston during the year 2023: - In recognition of his 5 years of service within the company, Winston received from his employer, in March 2023, a pair of tennis racquets worth $900. - On January 20, 2023, to mark his birthday, MVI gave Winston a coffee machine worth $350 as a gift, - At the 2023 Christmas party, MVI gave a gift card worth $450 to each of its employees. This gift card can be used at any store that accepts debit or credit card payments. g) During the year 2023, MVI paid for the following two training courses in Winston: -A 45-hour Japanese language course at UQAM at a cost of $420. Winston would like to eventually visit Japan in 2024 for his vacation and has therefore taken a course to learn basic Japanese. - A course on new practices in programming and task automation at a cost of $800. This course will allow Winston to help MVI customers automate certain complex tasks and thus save time. h) In order to ensure that Winston is well involved in the company and that he invests in the company for the long term, MVI management had him issue stock options in November 2022. of the society. These options allowed him to purchase 200 common shares of MVI for a price of $325 per share. At that time, the market value of one share was $325. In October 2023, Winston decided to exercise his options and therefore acquired 200 shares of the company at the price fixed by the option, i.e. $325 per share, while the market value of a share at that time was 390 $. These 200 shares then give him a 5% stake in the company*. *You must consider that Winston is not linked to the company and that he wishes to defer his taxation as late as possible while respecting the law. As part of his employment, Winston had to incur certain expenses at the request of his employer*. *The employer agrees to complete and sign form T2200. Please also consider that Winston informed his employer of any choice advantageous to him. i) Winston spent $3,500 to purchase a computer to carry out extensive computer simulations. This computer is very useful to him in his job. j) In December 2023, Winston took a business trip to New York on behalf of MVI and brought with him his partner Welma. Welma accompanied Winston at the request of MVI to allow Winston to concentrate on negotiations with business clients while she took care of organizing meetings, preparing documents and liaising with the Montreal office for Winston. The stay cost $6,100* and was fully reimbursed by MVI in Winston. *You must consider that the cost of the trip represents 50% for Winston and 50% for his partner. k) Also, Winston himself paid $3,200 for food and beverage expenses and $2,600 for accommodation expenses for all the trips he made during the year to outside the Montreal region for a period of more than 12 hours as part of their employment (excluding travel to New York). No allowance and no reimbursement was received for these various travel expenses. 1) Finally, Winston has the obligation, under his employment contract, to maintain an office by himself and to pay the costs associated with this office. So, Winston uses a room in his house with a separate entrance to meet with clients on a regular basis. Additionally, this room is used only for work. The room represents 25% of the surface area of the house. Here are some costs associated with his residence for the 9 months of the year 2023: Residence-related expenses Amount ($) Electricity, heating, water and internet in the house 6.000 Home maintenance 2700 Home insurance premiums for the 9 months of 2023 1 200 Property taxes for the 9 months of 2023 Office supplies 1.900 300 Questions: 1.1 Calculate Winston's net income from office and employment for the year 2023 at the federal level by presenting the income inclusions separately from the deductions. Provide details of your calculations. We suggest that you present your calculation of net tax business income in the form of a table. When you have to choose the lesser of two or the lesser of three amounts, be sure to indicate all amounts before making your choice. 1.2 If amounts mentioned in the statement have no effect on income from office and employment and should not be considered in the calculation of net income from office and employment, mention them separately (in a section 1.2) specifying whether the amount in question is non-taxable or non-deductible. Please indicate these amounts (in dollars) separately from section 1.1.

Step by Step Solution

There are 3 Steps involved in it

Unfortuna... View full answer

Get step-by-step solutions from verified subject matter experts