Question: Case 1 (24 Marks): Wonderplayer develops video game products for consumers. In June 2012, a team of analysts issued a research report that valued Wonderplayers

Case 1 (24 Marks):

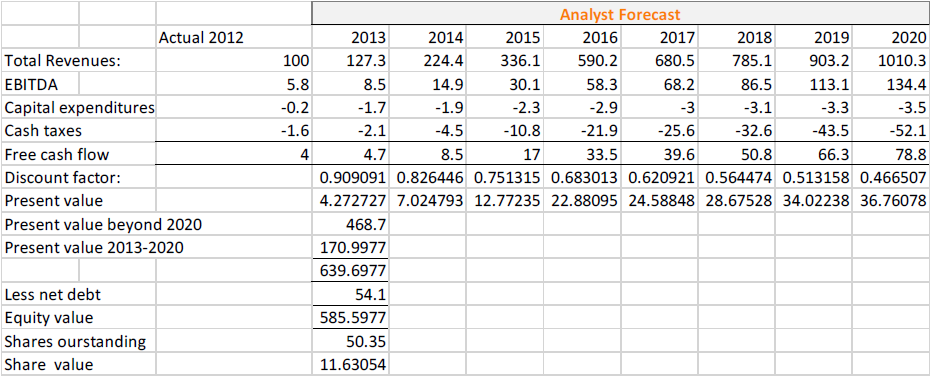

Wonderplayer develops video game products for consumers. In June 2012, a team of analysts issued a research report that valued Wonderplayers stock at $11.6 per share, compared to the then-current market price of $13. The research reports discounted cash flow valuation table is reproduced below. The 2012 figures are as reported by Wonderplayer, but the 2013 through 2020 figures are analysts forecasts. Key assumptions include a weighted average cost of capital of 10% and a perpetual growth rate of 2%. All dollar amounts are in millions except share value.

What share value estimate would the Wonderplayer have calculated if they had used an abnormal earnings value approach rather than a discounted cash flow approach and had developed forecasts?

Please help me with this question

Actual 2012 Total Revenues: EBITDA Capital expenditures Cash taxes Free cash flow Discount factor: Present value Present value beyond 2020 Present value 2013-2020 100 5.8 -0.2 -1.6 4 Analyst Forecast 2013 2014 2015 2016 2017 2018 2019 2020 127.3 224.4 336.1 590.2 680.5 785.1 903.2 1010.3 8.5 14.9 30.1 58.3 68.2 86.5 113.1 134.4 -1.7 -1.9 -2.3 -2.9 -3 -3.1 -3.3 -3.5 -2.1 -4.5 -10.8 -21.9 -25.6 -32.6 -43.5 -52.1 4.7 8.5 17 33.5 39.6 50.8 66.3 78.8 0.909091 0.826446 0.751315 0.683013 0.620921 0.564474 0.513158 0.466507 4.272727 7.024793 12.77235 22.88095 24.58848 28.67528 34.02238 36.76078 468.7 170.9977 639.6977 54.1 585.5977 50.35 11.63054 Less net debt Equity value Shares ourstanding Share value Actual 2012 Total Revenues: EBITDA Capital expenditures Cash taxes Free cash flow Discount factor: Present value Present value beyond 2020 Present value 2013-2020 100 5.8 -0.2 -1.6 4 Analyst Forecast 2013 2014 2015 2016 2017 2018 2019 2020 127.3 224.4 336.1 590.2 680.5 785.1 903.2 1010.3 8.5 14.9 30.1 58.3 68.2 86.5 113.1 134.4 -1.7 -1.9 -2.3 -2.9 -3 -3.1 -3.3 -3.5 -2.1 -4.5 -10.8 -21.9 -25.6 -32.6 -43.5 -52.1 4.7 8.5 17 33.5 39.6 50.8 66.3 78.8 0.909091 0.826446 0.751315 0.683013 0.620921 0.564474 0.513158 0.466507 4.272727 7.024793 12.77235 22.88095 24.58848 28.67528 34.02238 36.76078 468.7 170.9977 639.6977 54.1 585.5977 50.35 11.63054 Less net debt Equity value Shares ourstanding Share value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts